Advertisement|Remove ads.

Sempra Stock Drops To One-Year Low On Q4 Earnings Miss, Lower Guidance – Retail Traders See Dividend Bargain

Sempra Energy’s (SRE) stock tumbled more than 20% in afternoon trading Tuesday, hitting a one-year low after the utility’s fourth-quarter results and downgraded guidance fell short of Wall Street’s expectations.

The sharp decline made Sempra the second-worst performer in the S&P 500, behind only Hims & Hers Health (HIMS), as broader market weakness persisted.

U.S. equities slid after the Conference Board reported that consumer confidence fell to 98.3 in February, missing the Dow Jones estimate of 102.3 and marking the steepest monthly decline since August 2021.

Sempra reported adjusted earnings of $1.50 per share, missing analysts’ forecasts of $1.60, according to Koyfin.

Revenue came in at $3.76 billion, far below the expected $5.13 billion – a miss of more than 26%.

Beyond the earnings miss, the company’s guidance appeared to weigh most heavily on the stock.

Sempra lowered its full-year earnings forecast, citing “regulatory matters and the backdrop of a higher-cost environment.” The company now expects earnings between $4.30 and $4.70 per share, down from its previous range of $4.90 to $5.25.

The utility also issued its 2026 outlook, projecting earnings between $4.80 and $5.30 per share, below the $5.56 analysts had expected.

Despite the near-term challenges, Sempra maintained that long-term trends in energy security and decarbonization remain favorable for its infrastructure business.

The company highlighted progress on projects in the U.S. Gulf and northern Mexico while reaffirming the role of U.S. liquefied natural gas exports in supporting energy diversification for international allies.

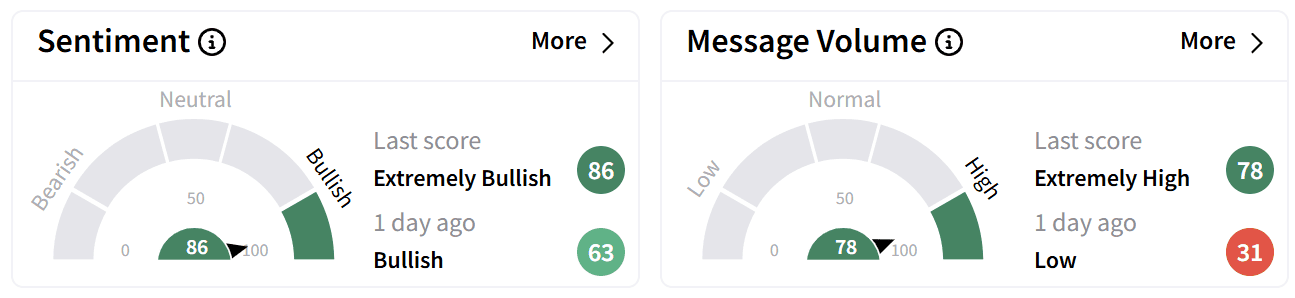

On Stocktwits, retail sentiment around Sempra's stock turned higher despite the sell-off. The sentiment score surged into ‘extremely bullish’ territory, with chatter levels spiking to ‘extremely high’ levels after trending at ‘low’ levels a day earlier.

Investors on the platform expressed optimism about the stock’s near-term prospects, given the discount and dividend yield.

Including Tuesday’s losses, Sempra’s stock has declined 3.5% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)