Advertisement|Remove ads.

SGBX Stock In Spotlight After Subsidiary Acquires 51% Stake In Winchester Oil And Gas – Retail Turns Bullish

Shares of Safe & Green Holdings Corp (SGBX) were in the spotlight on Tuesday after the company announced that its wholly owned subsidiary, Olenox Corp., has purchased a 51% stake in Winchester Oil and Gas.

Olenox specializes in acquiring and revitalizing distressed energy assets, leveraging proprietary technologies to enhance production while minimizing environmental impact.

Winchester operates over 500 wells in Texas. The company recently reported production of approximately 50 barrels a day, with peak production reaching 200 barrels in the last four years.

The company holds a $250,000 bond, which allows Olenox unlimited well licenses in Texas. The company believes this is ideal for expansion while also utilizing the cleanup of underperforming properties.

Safe & Green Holdings CEO Michael McLaren said the company’s Machfu technology allows it to reduce downtime, operator, and energy costs with its integrated bidirectional well-monitoring systems.

“Reduced costs mean reduced lifting costs per barrel and in volatile markets allows Olenox to remain profitable even at historically low pricing per barrel,” he said.

In 2024, Safe & Green Holdings reported a revenue of $4.9 million, compared to $15.5 million for the twelve months ended Dec. 31, 2023, primarily reflecting a decrease in construction services revenue.

However, net loss narrowed to $22.6 million or $10.53 per share in 2024, compared to $26.2 million or $34.03 per share in 2023.

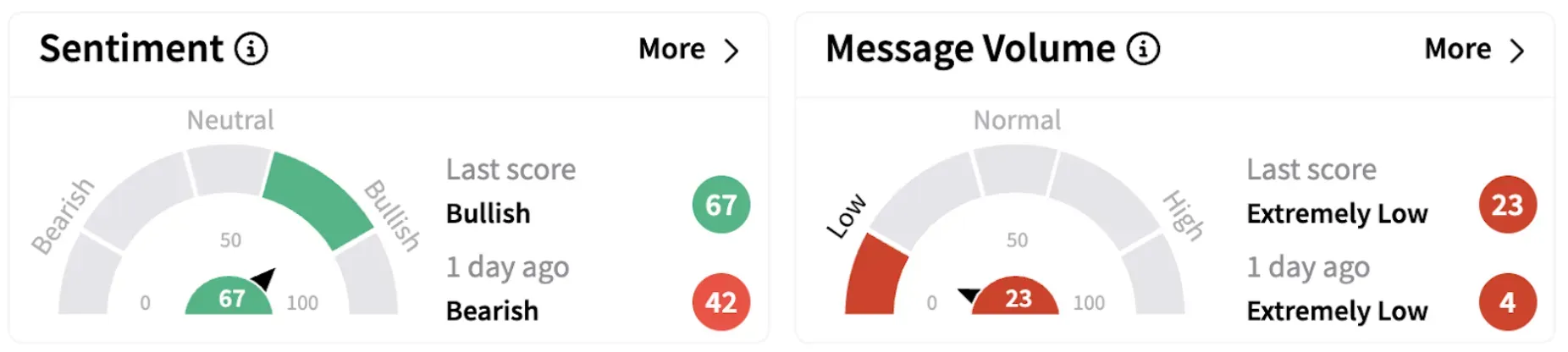

Meanwhile, on Stocktwits, retail sentiment flipped into the ‘bullish’ zone (67/100) from ‘bearish’ a day ago.

SGBX shares have declined over 30% year-to-date and over 89% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)