Advertisement|Remove ads.

Short Interest In Krispy Kreme Stock Spikes As Retail Sentiment Craters

Short interest in Krispy Kreme (DNUT) continues to soar as its stock sinks following another disappointing earnings report earlier this month.

Shorting a stock means borrowing and selling it, hoping to buy it back later at a lower price for profit. Investors taking this position expect the stock to fall, which signals a negative sentiment.

Shorts as a percentage of free float jumped five percentage points to a record high of 32.2, according to The Fly, which cited figures from financial data platform Ortex.

The time taken for short sellers to buy back or “cover” their borrowed shares has also increased from 5.1 days to 5.8 days earlier.

On March 8, Krispy Kreme withdrew its annual forecast and suspended a partnership with McDonald's (MCD), crashing its shares 16% to an all-time low the next day.

The partnership, which enabled sales of Krispy Kreme donuts at McDonald's outlets, was expected to be a key growth catalyst, and analysts quickly slashed their ratings on the donut sellers after its withdrawal.

Krispy Kreme said it would reset the agreement terms before relaunching in McDonald's outlets.

The company missed on the top line in Q1, and offered below-consensus Q2 guidance.

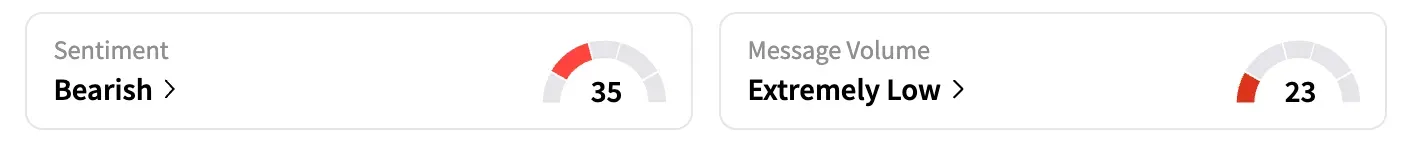

On Stocktwits, the retail sentiment for Krispy Kreme was 'bearish.'

DNUT shares, still trading around their all-time low, are down 71% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)