Advertisement|Remove ads.

Shriram Finance Tests ₹620 Support As Bearish Sentiment Builds Before Earnings: SEBI RA Rohit Mehta

Shriram Finance shares fell by over 4% on Friday, ahead of the company's earnings announcement. It is expected to post double-digit growth in net interest income (NII) for Q1FY26, supported by strong loan growth, according to reports. Profit after tax is estimated to grow 7% to ₹2,131 crore.

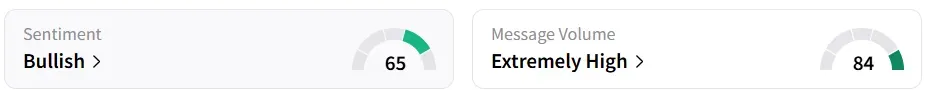

Retail sentiment on Stocktwits remained ‘bullish’, amid ‘extremely high’ message volumes.

Technically, the stock is currently trading just below a critical support zone of ₹620 - ₹660, having corrected over 11% from its all-time high of ₹718.10 hit in September last year, said SEBI-registered analyst Rohit Mehta.

The stock is testing this support after forming a rounding bottom pattern, but recent price action indicates a sideways to weak bias, Mehta noted.

A sustained bounce from this level could trigger a potential trend reversal, while a breakdown below ₹620 may lead to further downside.

Fundamentally, the company remains in a strong position, with a 5-year profit CAGR of 26.7% and a dividend payout of 21.4%. However, recurring concerns surrounding its low interest coverage ratio and declining promoter stake over the last three years have dampened sentiment, Mehta said.

Last quarter, the company reported a 20.8% increase in revenue and a 5.5% rise in financing profit. However, both profit before tax (PBT) and EPS slumped sequentially, indicating some short-term weakness.

Overall, a strong Q1 showing could potentially lead to the stock rallying above ₹660.

Year-to-date, the shares have gained 5.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)