Advertisement|Remove ads.

Skyworks Stock Hits 5-Year Low Despite Q1 Earnings Beat As Apple iPhone Business Shrinks: Retail Sentiment Sours

Skyworks Solutions Inc. (SWKS) lost nearly a quarter of its market capitalization, with the shares falling to a five-year low at Wednesday’s market open despite beating first-quarter earnings expectations.

The sharp decline followed the company’s warning that increased competition for Apple Inc.’s (AAPL) semiconductor business would dent future sales.

The stock last traded at these levels in May 2019.

Apple is Skyworks’ largest customer, and the company revealed during its earnings call that its share of supplying Apple with radio-frequency (RF) components is expected to drop by 20% to 25%.

“We developed really high-performance RF solutions. And unfortunately, we didn't really get what we targeted,” Skyworks CFO Kris Sennesael explained.

For the fiscal first quarter of 2025, Skyworks reported earnings of $1.60 per share, beating an analyst estimate of $1.20.

Revenue came in at $1.07 billion, exceeding Koyfin’s consensus estimate of $946 million.

CEO Liam Griffin pointed to growth in non-Apple business segments, saying the company has observed consistent improvement in demand indicators within Broad Markets and has successfully supported multiple new product launches in Mobile.

“Furthermore, we posted another quarter of impressive free cash flow with margins exceeding 30%,” he said.

The company also named Philip Brace its new chief executive and unveiled a $2 billion stock buyback.

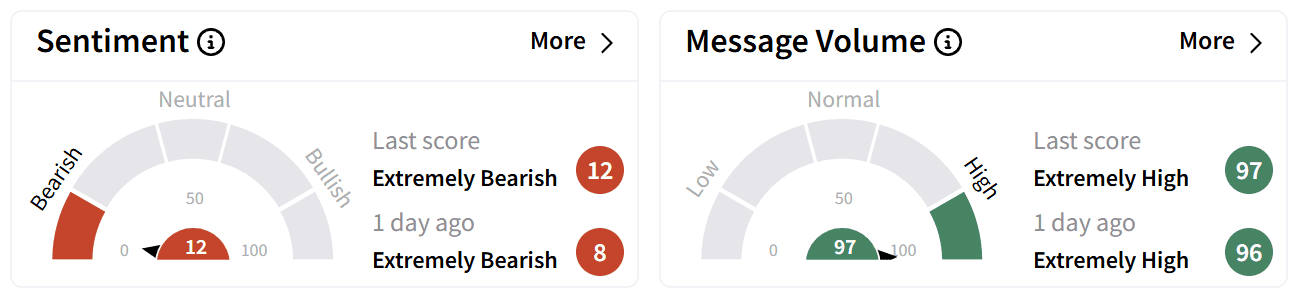

On Stocktwits, retail sentiment around Skyworks continued to trend in the ‘extremely bearish’ territory while chatter remained at ‘extremely high’ levels.

Retail traders on Stocktwits expressed concern about Skyworks’ lost business at Apple. Some sought clarity on which competitors gained market share.

Others indicated plans to sell shares upon a potential price recovery, citing Apple’s declining orders as a key concern.

Skyworks’ stock is down over 25% so far this year. Over the past year, the stock has lost over 33% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229019912_jpg_3e9bff3d29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)