Advertisement|Remove ads.

SLB Stock In Focus After Multiple Analysts Revise Price Target: Retail’s Extremely Bearish

The world’s largest oilfields services company, SLB ($SLB), received multiple analyst price target revisions after the firm reported its third-quarter results last week.

Barclays reportedly lowered its price target on SLB to $61 from $63, while keeping an ‘Overweight' rating on the stock. The brokerage noted that SLB continued to hit its targets with a standout quarter from digital, but the focus remained on the slowing spending cycle in 2025, which revised numbers lower.

At the same time, Stifel, too, lowered its price target on the stock to $60 from $62, while keeping a ‘Buy’ rating on the shares. The brokerage reportedly said SLB’s Q3 results, Q4 guidance, and the 2025 outlook support its belief that the risk/reward in the shares remains favorable and that the company is well positioned for a strong growth and robust free cash flow over the next few years.

For the third quarter, SLB saw its revenue fall short of estimates. Revenue rose 9% year-on-year (YoY) to $9.16 billion in Q3 compared to Wall Street estimates of $9.3 billion.

Earnings per share (EPS) stood at $0.89 versus an estimate of 0.88. Meanwhile, net income attributable to SLB rose 6% YoY to $1.19 billion during the quarter.

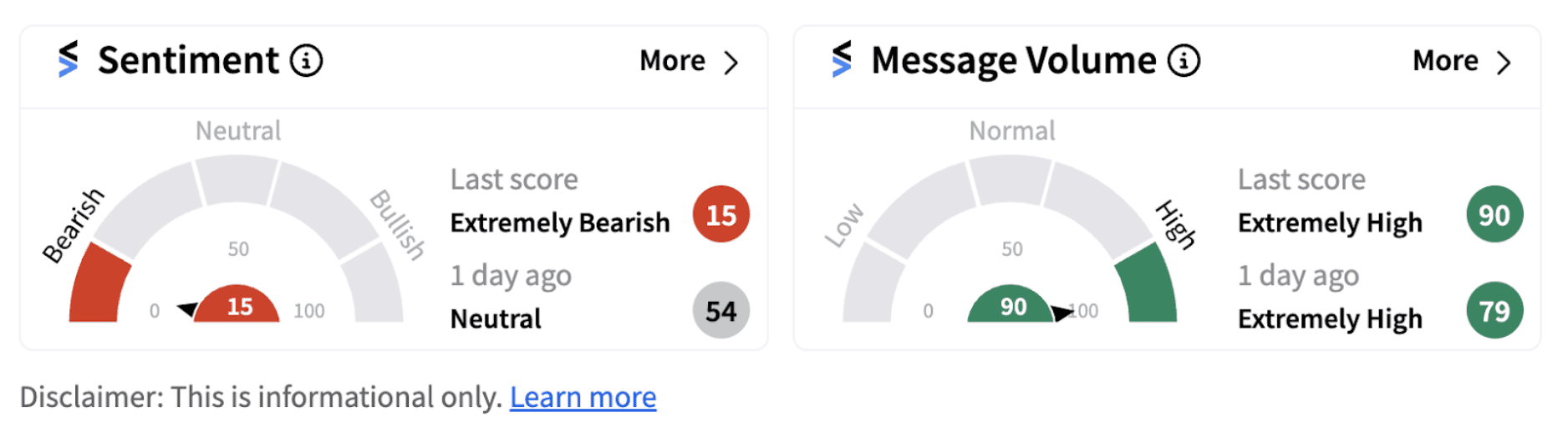

Retail sentiment on Stocktwits was trending in the ‘extremely bearish’ zone on Monday compared to ‘neutral’ a day ago, accompanied by ‘extremely high’ message volume.

CEO Olivier Le Peuch had said the firm’s earnings growth and margin expansion came in line with its full-year adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margin goal of 25% or higher. SLB posted an adjusted EBITDA margin of 25.6%, registering a 55-bps sequential increase.

“These results were achieved by our ongoing focus on cost optimization, greater adoption of our digital products and solutions, and the contribution of long-cycle projects in deep water and gas,” he noted.

The CEO also pointed out that revenue grew in the Middle East and Asia and offshore North America but was offset by a decline in Latin America, while Europe & Africa held steady.

Meanwhile, SLB shares are down over 19% since the beginning of the year.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)