Advertisement|Remove ads.

Small and Micro-Cap Movers: Key News, Market Reactions, and Insider Chatter

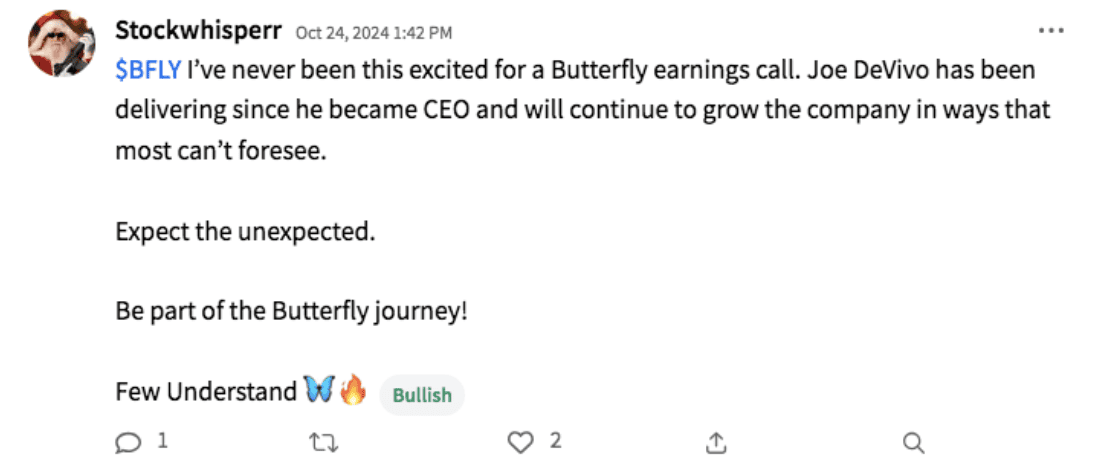

1) Butterfly Network (NYSE: BFLY)

- Background: Butterfly Network is a digital health company pioneering accessible ultrasound technology through its handheld devices, with a mission to democratize high-quality imaging. The Butterfly iQ series has applications in multiple healthcare settings, enabling diagnostic imaging that is portable, affordable, and accessible.

- The News: Butterfly Network recently partnered with HeartFocus to launch an AI-driven training app for cardiac ultrasound, compatible with Butterfly’s portable iQ devices. The app is designed to help healthcare practitioners acquire essential diagnostic skills, even in remote and underserved areas, boosting Butterfly’s appeal to health professionals globally.

- What It Means: This partnership aligns with Butterfly’s vision of expanding ultrasound accessibility, particularly in resource-limited settings. By combining advanced AI-powered education with Butterfly’s handheld devices, the company positions itself as a leader in mobile diagnostics. As demand for accessible healthcare tech grows, Butterfly Network’s innovation could drive significant adoption and revenue growth.

- Stock Reaction: Shares of BFLY rose 3.8%, with trading volume showing heightened interest following the announcement. Investors appear optimistic that AI integrations will boost device uptake, especially among hospitals and clinics focused on remote care.

Stocktwits Insight:

2) Gilat Satellite Networks (NASDAQ: GILT)

- Background: With over 35 years of experience, Gilat Satellite Networks specializes in satellite-based broadband communication solutions, catering to sectors like government, defense, and enterprise. Known for its high-quality and scalable communication systems, Gilat has a strong global reputation in satellite technology.

- The News: Gilat was awarded a $4 million contract from the U.S. Department of Defense to supply DKET 3421 terminals, versatile communication hubs designed for field deployment. These terminals will enhance mission-critical communications, providing secure, mobile connectivity in challenging environments.

- What It Means: This contract reinforces Gilat’s standing as a trusted defense partner, underscoring the value of its portable satellite solutions in national security contexts. Such government contracts bring stable revenue and validate Gilat’s reliability in high-stakes applications.

- Stock Reaction: GILT shares rose 2.9% on above-average volume, reflecting investor confidence in Gilat’s steady pipeline of government contracts.

- Stocktwits Insight:

3) Power Nickel (TSXV: PNPN)

- Background: Power Nickel, a Canadian junior exploration company, focuses on nickel and other essential metals used in electric vehicle (EV) batteries. Its primary asset, the Nisk property in Quebec, has yielded high-grade nickel and copper, attracting attention within the green tech sector.

- The News: Power Nickel announced promising drill results from the Lion Zone, with intersections showing high concentrations of copper, gold, and palladium. These results enhance the project’s profile, potentially making Power Nickel a key player in sustainable, North American-based battery metals.

- What It Means: With demand for nickel and battery metals on the rise, Power Nickel’s findings position it well to meet the needs of EV manufacturers seeking local, reliable sources. The results are likely to attract both investment and strategic partnerships within the green energy sector.

- Stock Reaction: PNPN shares fell 2.41%, with trading volume up almost 100% from average indicating growing investor enthusiasm for Power Nickel’s expansion potential.

- Stocktwits Insight:

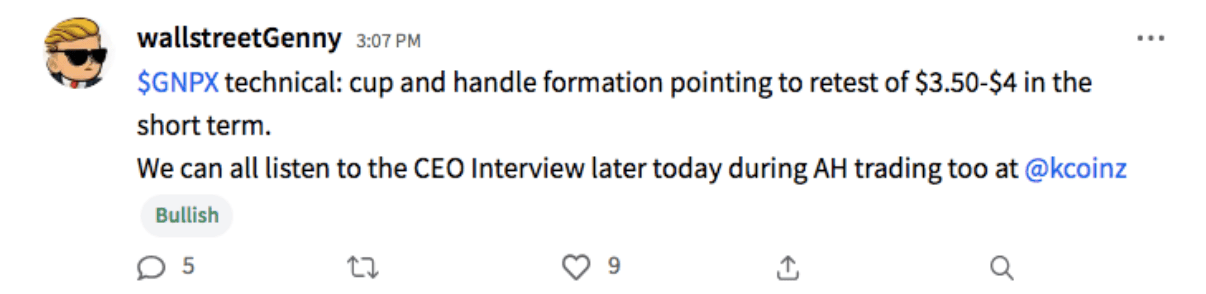

4) Genprex (NASDAQ: GNPX)

- Background: Genprex is a gene therapy company focused on cancer and diabetes treatments. Its flagship product, Reqorsa, aims to restore tumor-suppressor gene function in cancer patients, showing promise in treating resistant forms of lung cancer.

- The News: Genprex presented positive preclinical data on Reqorsa, showcasing potential effectiveness against KRAS-resistant lung cancer, glioblastoma, and mesothelioma. This data, shared at an international symposium, underscores Reqorsa’s potential as a versatile cancer therapy.

- What It Means: These findings reinforce Genprex’s pipeline credibility and could lay the groundwork for future clinical trials. If further studies replicate these results, Genprex may secure institutional investment as the therapy advances toward regulatory milestones.

- Stock Reaction: GNPX shares surged 38.4% on higher-than-normal volume, as the announcement generated interest among investors.

Stocktwits Insight:

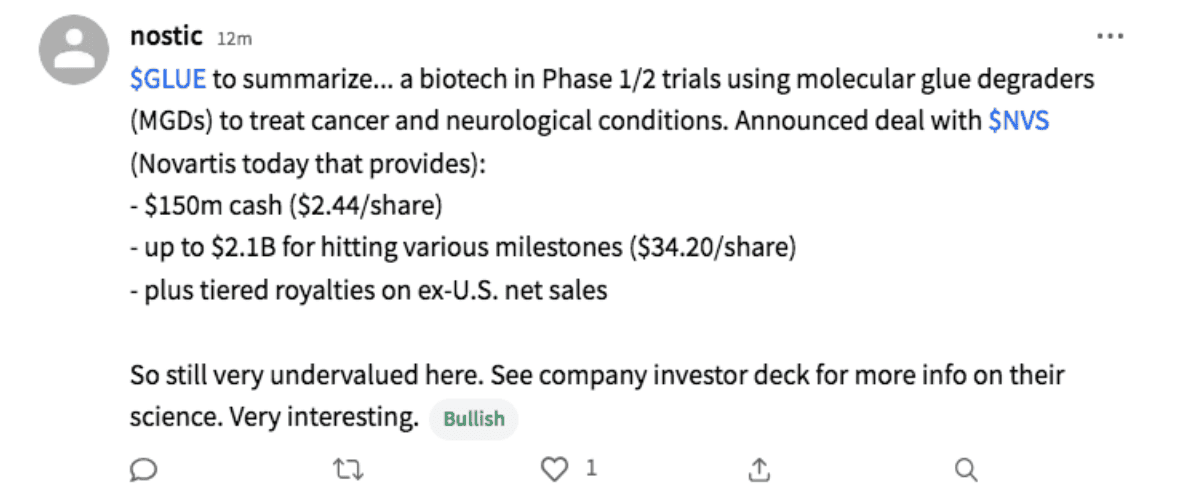

5) Monte Rosa Therapeutics (NASDAQ: GLUE)

- Background: Monte Rosa Therapeutics is developing molecular glue degraders, which eliminate disease-causing proteins. This unique drug class has potential applications in autoimmune diseases, inflammation, and other conditions with few existing treatments.

- The News: Monte Rosa announced a $150 million licensing agreement with Novartis to accelerate its VAV1-directed drug development program. The agreement provides Monte Rosa with significant financial backing to pursue its pipeline.

- What It Means: Partnering with Novartis offers Monte Rosa access to substantial resources and validation for its innovative therapy approach. This collaboration could enhance Monte Rosa’s position within the biotech landscape, while boosting investor confidence.

- Stock Reaction: GLUE shares jumped 93.9% as trading volume spiked, 27,000% reflecting market approval of the deal’s long-term growth potential.

Stocktwits Insight:

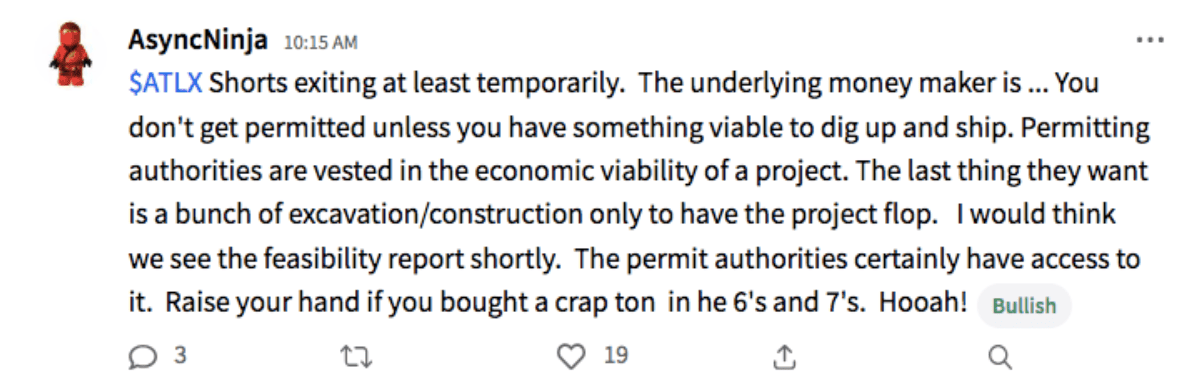

6) Atlas Lithium (NASDAQ: ATLX)

- Background: Atlas Lithium is a lithium exploration and development company working on the Neves project in Brazil’s “Lithium Valley.” With the global shift toward EVs and renewable energy storage, lithium is in high demand for battery production.

- The News: Atlas secured regulatory permits to proceed with lithium extraction and processing at the Neves site. These approvals allow Atlas to develop a processing plant, positioning it to become a lithium supplier in the rapidly expanding EV battery market.

- What It Means: This milestone accelerates Atlas’s journey to become a key player in the lithium supply chain. As EV adoption grows, Atlas’s Neves project may play a crucial role in meeting global lithium demand.

- Stock Reaction: ATLX shares gained 24.7% on increased trading volume (5x), as investors anticipate the project’s potential impact on Atlas’s valuation.

Stocktwits Insight:

7)Procept BioRobotics (NASDAQ: PRCT)

- Background: Procept BioRobotics specializes in robotic systems for urological procedures. Its AquaBeam Robotic System, a minimally invasive treatment for benign prostatic hyperplasia (BPH), has shown significant market growth.

- The News: Procept reported strong Q3 earnings, driven by increased AquaBeam sales and consumables. The company raised its revenue guidance, signaling robust demand and operational growth.

- What It Means: Procept’s earnings beat highlights its competitive edge in surgical robotics, particularly in the high-demand market for BPH treatment. The raised guidance reflects Procept’s confidence in continued market penetration and long-term revenue potential.

- Stock Reaction: PRCT shares rose 32.3% on significant volume (6x), with investors responding positively to the improved financial outlook.

Stocktwits Insight:

Join the Discussion on the WVC Facebook Investor Group

Have a Stock Tip or New Story Suggestion? Email us at: Invest@WealthyVC.com

Disclaimer: Wealthy VC does not hold a long or short position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.

This article was written by an independent contributor and does not reflect the views of Stocktwits. It has not been edited for content. The information provided here is intended solely for informational and educational purposes, and should not be interpreted as investment advice. Stocktwits does not endorse the purchase or sale of any security nor does it make any claims about the financial status of any company.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)