Advertisement|Remove ads.

SMCI Stock Dips After Hindenburg Research Discloses Short Position: Retail Sentiment Plummets

Hindenburg Research, known for its scathing reports on India’s Adani Group and billionaire activist investor Carl Icahn, has disclosed a short position on server-maker Super Micro Computer (SMCI) on Tuesday citing “fresh evidence of accounting manipulation, sibling self-dealing and sanctions evasion.”

Shares of SMCI fell over 3% on Tuesday, dragging retail sentiment down, following the disclosure.

Hindenburg Research said its three-month investigation into the firm found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.

The short-seller said that less than three months after paying a $17.5 million SEC settlement, Super Micro began re-hiring top executives that were directly involved in the accounting scandal, according to litigation records and interviews with former employees.

Hindenburg cited a former employee saying “almost all of them are back. Almost all of the people that were let go that were the cause of this malfeasance.”

This is important given the fact that SMCI was charged by the SEC by August 2020 for “widespread accounting violations,” primarily related to over $200 million in improperly recognized revenue and understated expenses, that resulted in artificially elevated sales, earnings and profit margins.

Hindenburg also stated that Super Micro’s relationships with both disclosed and undisclosed related parties “serve as fertile ground for dubious accounting.”

According to the short-seller, disclosed related party suppliers Ablecom and Compuware, controlled by Super Micro CEO Charles Liang’s brothers, have been paid $983 million in the last three years.

Hindenburg cited trade records to add that the related parties appear to do little other business with approximately 99.8% of Ablecom’s exports to the U.S. since 2020 going to Super Micro, and about 99.7% of Compuware’s U.S. exports made to Super Micro.

The short-seller also said exports of Super Micro’s high-tech components to Russia have spiked by approximately three times since the invasion of Ukraine, “apparently violating U.S. export bans,” according to its review of more than 45,000 import/export transactions.

“After extensive research, we have taken a short position in shares of Super Micro Computer, Inc. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report,” Hindenburg Research stated.

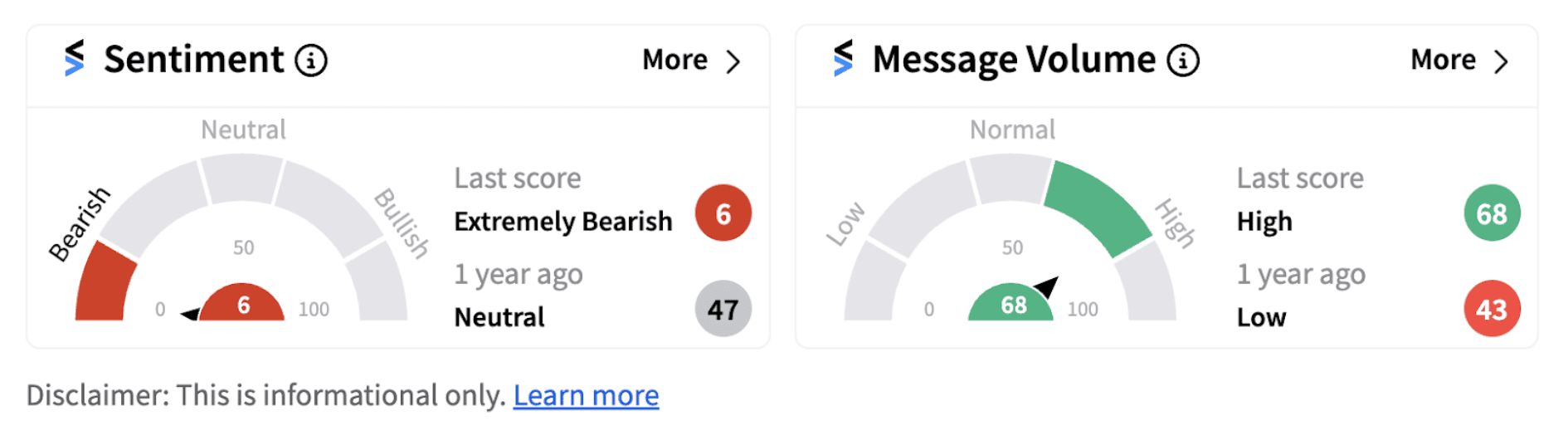

Retail investors on Stocktwits have gone ‘extremely bearish’ (6/100) on the stock with the metric hitting a one-year low. The stock has nearly doubled this year supported by the AI-fueled enthusiasm.

In the coming weeks, it will be interesting to watch whether investors decide to fall in line with Hindenburg Research’s take on the company or the AI-hype takes precedence over the allegations.

Also See: JD.com Stock Rises After New $5 Billion Share Repurchase Program: Retail Investors Exuberant

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)