Advertisement|Remove ads.

Super Micro Computer Stock Plunges On DOJ Probe Report, Retail Sentiment Nears 2024 Lows

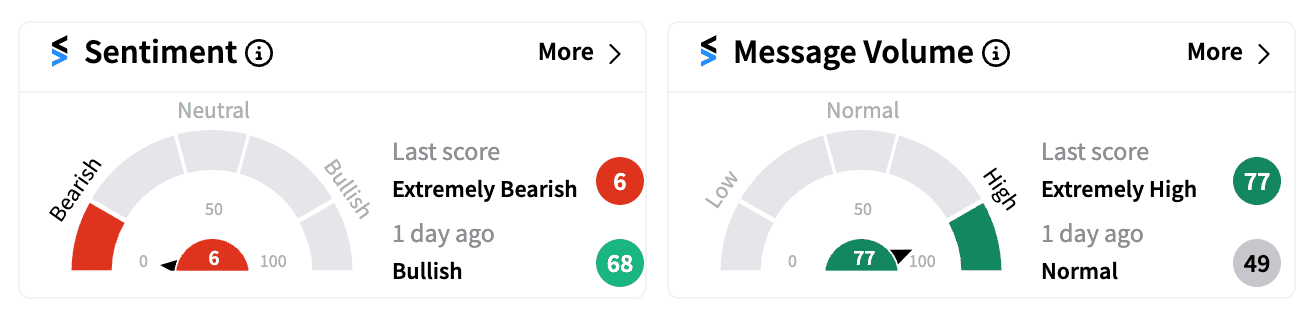

Shares of Super Micro Computer Inc. (SMCI) plunged 13% in morning trading on Thursday, causing retail investor sentiment on Stocktwits to plummet to 'extremely bearish' levels (6/100), close to the lowest mark of 2024.

The decline followed a report from The Wall Street Journal indicating that the server maker is under investigation by the U.S. Department of Justice.

Prior to the report’s release, which cited sources familiar with the investigation, SMCI stock was in the green.

The DOJ probe comes on the heels of a troubling report from short-seller Hindenburg Research in late August, which flagged potential accounting irregularities.

This revelation prompted Supermicro to delay its annual report to allow for further accounting checks.

The stock has faced mounting pressure after a disappointing earnings report earlier in August added to investor concerns.

SMCI, which was one of the hottest AI stocks up until August, has been hit with a wave of negative news that has reportedly dissuaded dip buyers amidst lingering questions regarding its financial practices.

Despite the recent turmoil, SMCI is still up approximately 39% year-to-date.

However, it has suffered a significant 53% decline over the past three months, making it the worst performer in the S&P 500 during that period.

Loop Capital on Monday lowered its price target on SMCI to $1,000 from $1,500, while maintaining a ‘Buy’ rating.

The brokerage emphasized that the company’s efforts to achieve gross and operating margins of 14% and 10%, respectively, alongside the resolution of its 10-K delay, are crucial.

The analyst noted that while the perception of Supermicro’s decline may be exaggerated, its role in the generative AI space remains undervalued.

Read next: Meta Pleases Wall Street With AI Product Roadmap: Retail Stays Happy As Stock Stays Red-Hot

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)