Advertisement|Remove ads.

SoFi Stock Closes At New Peak Ahead Of Q3: Here's How Retail's Positioned

- The stock is currently on a two-week winning streak amid expectations of a strong Q3 report and a Fed rate cut.

- Wall Street expects the company to post earnings of $0.09 per share on revenue of $895 million.

- Despite SoFi’s high valuation, most retail traders were looking at the stock as a long-term buy.

SoFi Technologies (SOFI) stock gained 3.2% in extended trading ahead of its earnings on Tuesday.

According to Fiscal.ai data, Wall Street expects the company to post earnings of $0.09 per share on revenue of $895 million. The consumer finance firm has topped estimates in three of the previous four quarters.

The stock gained 3.4% in the regular trading session on Monday, finishing the day at $30, the highest closing price for the shares, although off the all-time intraday high of $30.30, set on Sept. 22. SoFi shares are currently on a two-week winning run amid expectations of a strong Q3 report and a Fed rate cut.

What Is Retail Thinking?

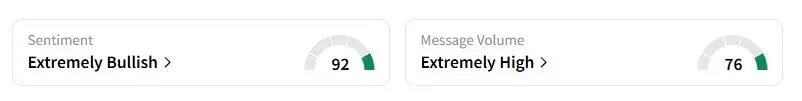

Retail sentiment on Stocktwits about SoFi was in the ‘extremely bullish’ territory at the time of writing, compared with ‘bullish’ a week ago.

One user, who identified himself as a real estate broker, said he was impressed with SoFi mortgage and called it a good sign for the company.

“I don’t believe anyone holding shares for the long term is worried about a sell-off tomorrow. Only people worried about that are traders, not long-term buy-and-hold investors,” another investor said.

How Does SoFi Compare To Peers?

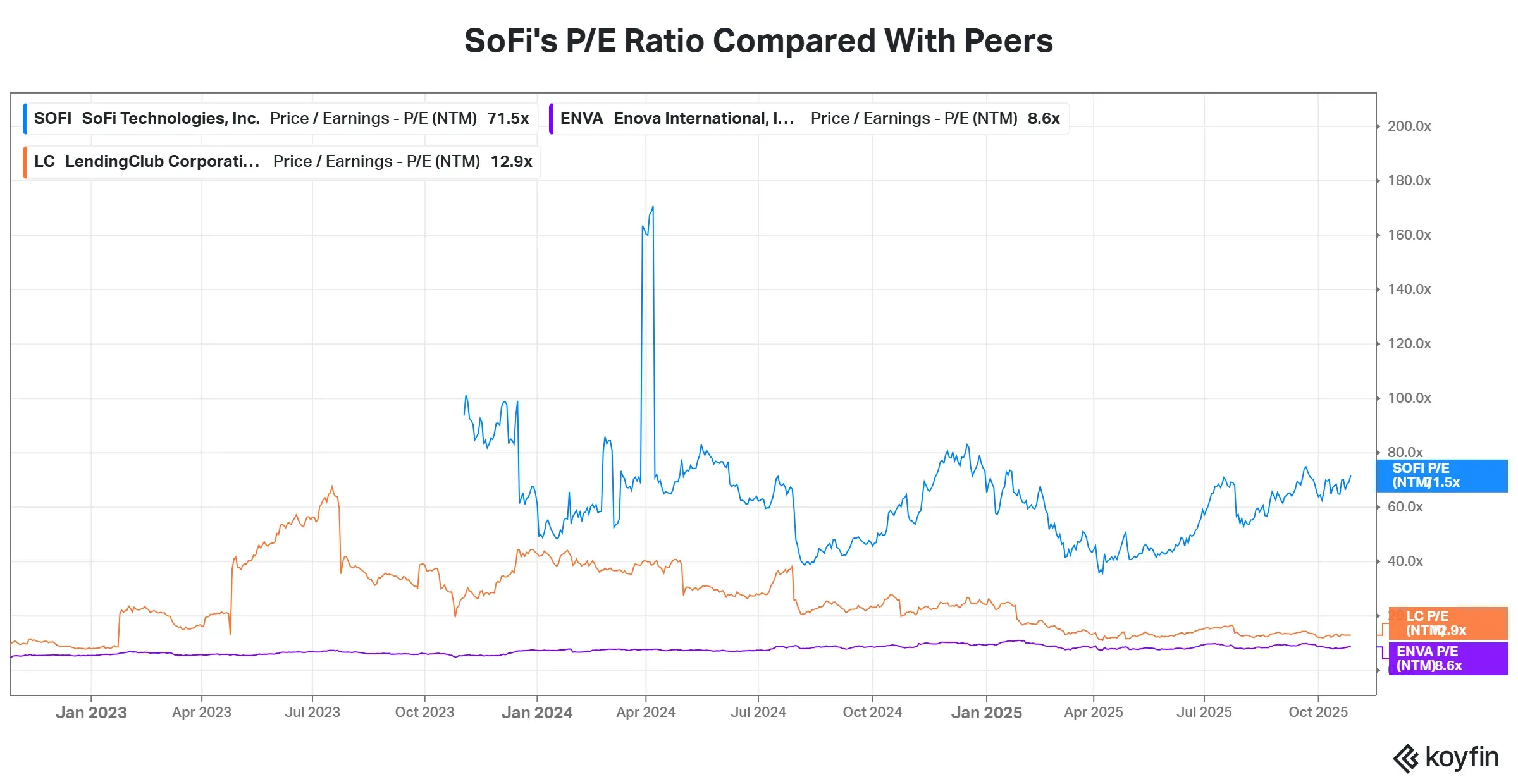

SoFi stock has doubled this year, compared with the 11.5% gains for peer LendingClub’s shares and the 25.7% rise in Enova’s shares. SoFi’s forward price-to-earnings ratio, a key valuation gauge, stands at 71.5, a significantly higher multiple than peers.

While "several positive potential catalysts" could bring support for SoFi shares in the near term, SoFi's risk/reward "seems skewed negatively over the long term given the premium valuation," Keefe Bruyette analysts said earlier this month, according to TheFly.

However, SoFi’s peers have posted blockbuster third-quarter earnings reports, buoying investor confidence. Lendingclub said last week its loan origination volume jumped 37% compared to a year earlier, while net income tripled. Another rival, Enova, also topped expectations and posted an 85% jump in earnings.

Consumer finance firms are also expected to benefit from rate cuts this year, which tend to boost loan originations. SoFi’s home loan originations already jumped 92% during the second quarter.

Also See: Why Did Chemical Maker Olin Corp’s Stock Fall After Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)