Advertisement|Remove ads.

Why Did Chemical Maker Olin Corp’s Stock Fall After Hours?

- The company posted quarterly sales of $1.71 billion, compared with estimates of $1.73 billion.

- “In addition to ongoing, subdued global epoxy demand, headwinds persist from subsidized Asian material flowing into the United States and European epoxy markets” — CEO Ken Lane.

- The firm projected fourth quarter 2025 adjusted EBITDA to be in the range of $110 million to $130 million.

Olin Corp (OLN) stock fell 5.6% in extended trading on Monday after the firm’s third-quarter revenue fell short of Wall Street’s estimates.

The chemical maker posted quarterly sales of $1.71 billion for the three months ended Sept. 30, compared to $1.59 billion in the year-ago quarter. However, the quarterly sales came in below $1.73 billion, according to Fiscal.ai data. Olin reported a net income of $42.8 million, or $0.37 per share, compared with a net loss of $24.9 million, or $0.21 per share, in the same period last year.

What Impacted Sales Growth?

Olin attributed the lackluster sales growth to subdued epoxy demand. “In addition to ongoing, subdued global epoxy demand, headwinds persist from subsidized Asian material flowing into the United States and European epoxy markets," CEO Ken Lane said.

The year-over-year (YoY) uptick was driven by higher volumes in its Chlor Alkali Products and Vinyls segment, slightly offset by lower prices. Its epoxy segment also posted an uptick in sales, driven primarily by higher output, compared to the year-ago quarter, when Hurricane Beryl impacted its production.

S&P Global Market Intelligence's PMI surveys indicated that worldwide business activity slowed for the first time in five months during September, as weakness in some developed countries took the shine off strong demand growth in several emerging economies.

Global manufacturing has taken a hit due to the Trump administration's dynamic tariff policy. However, as per the S&P Global survey, business sentiment is improving.

What Is Retail Saying?

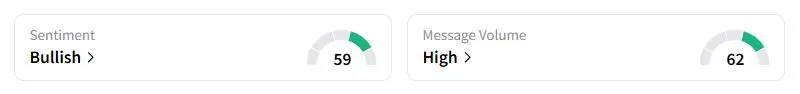

Retail sentiment on Stocktwits about Olin was in the ‘bullish’ territory at the time of writing.

“Very cyclical - there are some positives though, really LOOOONG term picture here, 3 years maybe to get back to [the] $60s,” one user wrote.

What Did Olin Forecast For The Fourth-Quarter (Q4)?

"The fourth quarter market environment is typically the weakest seasonal quarter for our businesses. As a result, we expect Olin's fourth quarter 2025 adjusted EBITDA to be in the range of $110 million to $130 million, which includes a $40 million penalty from planned inventory reductions,” Lane said in a statement.

Olin stock has fallen 29.5% this year, compared with over 22% gains in the Invesco Dorsey Wright Basic Materials Momentum ETF (PYZ).

Also See: UPS Q3 Earnings Preview: Tepid Demand To Weigh In, De Minimis Impact In Focus

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)