Advertisement|Remove ads.

SoFi Stock Plunges After-Hours On $1.5B Offering — Retail Feels Only An Acquisition ‘Makes Sense’

SoFi Technologies (SOFI) stock slipped 6.6% in extended trading on Tuesday after the fintech firm launched a public offering of $1.5 billion worth of common stock after posting strong second-quarter earnings.

According to a Bloomberg News report, the company is offering the shares for $20.85 to $21.50 apiece. The aftermarket decline wiped out all the gains in the regular session, in which SoFi stock closed at $22.40, following a 6.6% jump.

The company said that Goldman Sachs is acting as the underwriter for the offering. SoFi intends to utilize the cash raised from the offering for general corporate purposes, including working capital and other business opportunities. It will also grant the underwriter a 30-day option to buy up to an additional 15% of the shares of common stock made available in the offering.

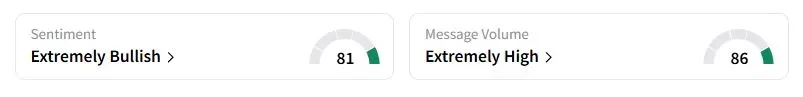

Retail sentiment on Stocktwits about SoFi stock was ‘extremely bullish’, while retail chatter was ‘extremely high.’

“An acquisition is the only thing that makes sense here. I expect an announcement within the next 2 weeks,” one trader said.

“(The) business is on an aggressive growth trajectory. $1.5 billion is going to provide fuel to that growth. This has lots of runway to expand upward,” another user noted.

Earlier on Tuesday, the company received endorsement from several Wall Street brokerages after posting upbeat second-quarter earnings.

In a note to clients, William Blair analysts said Wall Street has only begun to grasp the pace and scope of SoFi’s digital banking model, which it described as ‘disruptive’, as per TheFly. Jefferies analyst John Hecht reportedly wrote that the beat-and-raise report suggests momentum will likely continue for the rest of the year.

SoFi stock has gained over 49% this year.

Also See: Trump Warns ‘Good Friend’ India May Be Hit With 25% Tariff: ‘You Just Can’t Do That’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)