Advertisement|Remove ads.

SoFi Stock Surges On $2B Fortress Loan Deal, Retail Excitement Builds

Shares of SoFi Technologies ($SOFI) jumped more than 8% on Monday, sparking a wave of excitement from retail investors.

The company announced a $2 billion loan platform agreement with affiliates of Fortress Investment Group, a deal aimed at expanding SoFi’s personal loan capabilities.

Under the agreement, SoFi will refer pre-qualified borrowers to its loan origination partners and originate loans for third parties.

“SoFi’s loan platform business is an important part of our strategy to serve the financial needs of more members and diversify toward less capital-intensive and more fee-based sources of revenue,” said Anthony Noto, CEO of SoFi.

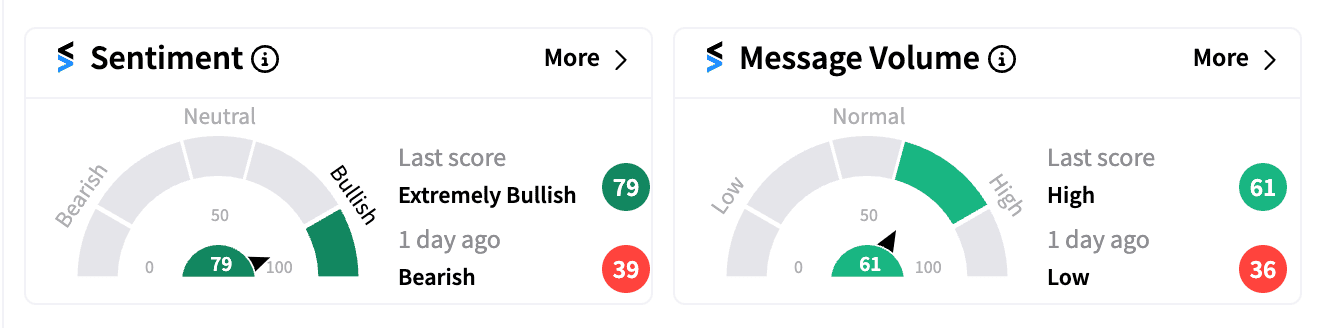

On Stocktwits, retail sentiment for SOFI shifted from ‘bearish’ to ‘extremely bullish’ within 24 hours, with a significant surge in message volume as of Monday morning.

According to Bloomberg, it’s becoming more common for fintech companies to collaborate with private-credit lenders like Fortress to finance consumer loans. Examples include Upstart Holdings’ recent partnerships with Blue Owl Capital, Castlelake, and Centerbridge Partners.

Such deals are reportedly appealing to banks and financial institutions that prefer not to hold capital-heavy consumer loans on their balance sheets. Fortress recently made a similar financing deal with Best Egg earlier this month.

SoFi describes itself as a “member-centric, one-stop shop for digital financial services,” with nearly 8.8 million members using its platform to borrow, save, spend, invest, and protect their money through a unified app.

Fortress Investment Group, founded in 1998, is a global investment manager with $48 billion in assets under management as of June 30, 2024.

SoFi’s stock has lost about 0.25% so far this year, as it tries to emerge from a high interest rate environment and the fallout of the Biden administration’s pause on student-loan repayments last year, which crimped its business.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)