Advertisement|Remove ads.

Sony Stock Surges After Q3 Earnings Beat, Raised Outlook: Retail’s Not Convinced

U.S. shares of Sony Group Corp. ($SONY) surged more than 6% on Thursday after the company posted better-than-expected third-quarter results and revised its 2024 outlook, lifting retail sentiment.

Sony Q3 earnings per share came at about JPY 61.82 ($0.40) beating consensus estimates of $0.30, while revenue, up 18% year-over-year, stood at about $28.8 billion, surpassing estimates of $24.24 billion, according to Stocktwits data.

According to the company, Sony’s gaming segment profit increased 37% in the last quarter, which was helped by higher sales from network services and lower hardware losses. Sony’s PlayStation 5 consoles sold 9.5 million units, up from 8.2 million in the same period last year.

Responding to the threat of U.S. tariff policy, Sony said the company is working towards duplicating its supply chains and increasing flexibility. It is also “stockpiling a certain level of strategic inventory in the U.S.”, according to a company statement, adding it expects the impact on its financial performance this fiscal year of the additional U.S. import tariffs to be minor.

For full-year 2024, Sony expects revenue to be about JPY 13.2 trillion ($876 billion), 4% higher than its previous outlook. It also revised up its annual operating profit by 2% to JPY 1.34 trillion.

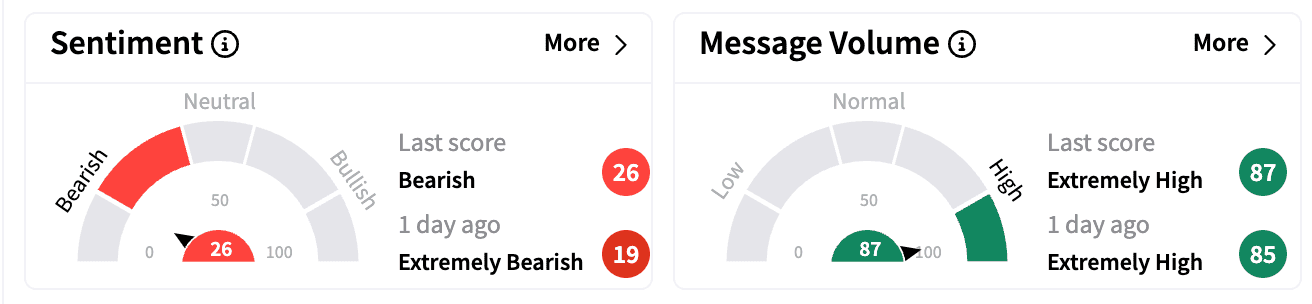

Sentiment on Stocktwits improved to ‘bearish’ from ‘extremely bearish’ a day ago. Message volumes continued to be in the ‘extremely high’ zone.

Quarterly sales for its music segment increased 14% year-on-year to JPY 481.7 billion, primarily due to higher streaming revenue and the impact of the consolidation of eplus in its visual media and platform. Sales in the pictures segment increased 9% year-on-year to JPY 398.2 billion primarily due to higher revenue from theatrical releases such as “Venom: The Last Dance.”

Sony stock is up 9.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)