Advertisement|Remove ads.

'SPAC King' Chamath Palihapitiya's 2020 Short Case On GOOGL, META Aged Terribly — They Would've Turned $1,000 Into A Small Fortune

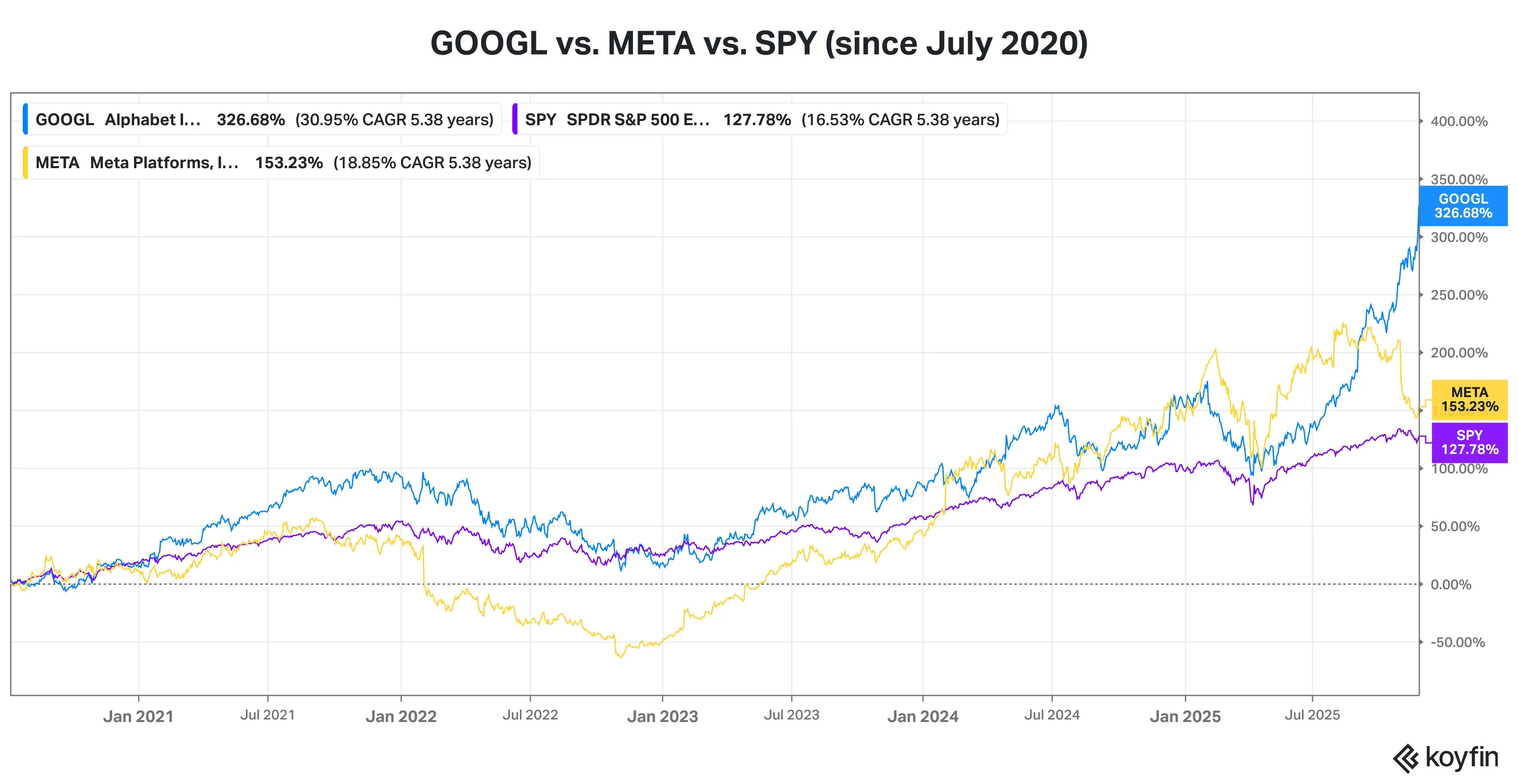

- Palihapitiya warned of regulation and stagnation, but Alphabet is up ~325% and Meta ~150% since 2020.

- A $1,000 investment in each would now be worth roughly $4,237 (GOOGL) and $2,523 (META), respectively.

- Analysts still see upside, with Meta’s one-year return potential near 38% and Alphabet supported by AI, cloud, and quantum growth pillars.

Amid the rising short calls on some of the artificial intelligence darlings that have led the market rally since the late 2022 bear market bottom, a social media user deemed it fit to highlight how a similar short call made by venture capitalist Chamath Palihapitiya half a decade back fell flat.

Palihapitiya is a Canadian-American entrepreneur who is seen as the face of the 2020-21 Special Purpose Acquisition Company (SPAC) boom.

VC’s Past Big Tech Pushback To The Fore

In a post on X in July 2020, the “SPAC King” listed a few supporting factors for his “growing short case” on Facebook, which later rebranded itself as Meta Platforms, Inc. (META), and Alphabet, Inc. (GOOGL) (GOOG). Among the concerns he flagged were new product experiences, regulation, taxes and antitrust risk.

He panned the big techs, which, due to their incumbent status, fell into the rut of “lack of creativity, sloth, internecine politics, and waste.” At that time, the entrepreneur predicted that customers of these big techs would slow spending velocity as governments across the world, threatened by the dominance of these companies, tighten their regulatory tentacles.

Revisiting the post, a social media user said, “If you had max longed FB and GOOGL in July 2020, you would have generational wealth for you and your family.”

Missed Opportunity?

Among the stocks singled out by Palihapitiya, Alphabet is at a record high, and Meta, which traded with substantial gains for much of this year, has suffered a setback since its quarterly results release in late October.

Assuming an investor had invested $1,000 in Alphabet and Meta, ignoring Palihapitiya’s warning, their returns would have been as follows:

Alphabet, Inc:

- $1000 would have fetched 13.3 GOOGL shares (July 9, 2020, closing price was $75.41)

- 13.3 GOOGL shares would now be worth $4,237

-A return of about 325% in five years versus SPY’s return of 128%

Meta Platforms Inc.

-$1,000 would have fetched 4.1 shares (July 9, 2020, closing price was $243)

-4.1 META shares would now be worth roughly $2,523

-A return of over 150% in five years, vis-a-vis SPY’s return of 128%

The returns do not assume reinvestment of profits or include dividend payments. If not for the downturn during 2022, the returns would have been much higher.

Source: Koyfin

More importantly, analysts are optimistic about further upside for these two shares. According to Koyfin-compiled consensus price targets for Alphabet and Meta, the one-year return potential for their shares are 1.4% and 38%, respectively.

Over the years, Big Techs have added more flywheels to their businesses and diversified their revenue streams, thereby insulating themselves against weaknesses on any particular front. Google parent Alphabet, for one, now has a thriving search business, bolstered by its AI integration, a cloud unit, and its video streaming business. It has also made meaningful inroads into the quantum computing industry.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)