Advertisement|Remove ads.

Spot Silver Crosses $70 An Ounce For The First Time

- Spot prices rose around 2% to $70.48 an ounce

- Silver futures for March 2026 deliveries jumped 2.5% to $70.34 an ounce.

- Hecla Mining gained 3% premarket and is on track to trade at its highest levels in over 38 years

Spot Silver prices (XAG/USD) surged past $70 an ounce for the first time on Tuesday, as the precious metal continued its record-breaking rally this month.

While spot prices rose around 2% to $70.48 an ounce, silver futures for March 2026 deliveries jumped 2.5% to $70.34 an ounce.

Meanwhile, silver miner Hecla Mining (HL) gained 3% premarket and is on track to trade at its highest levels in over 38 years. The iShares Silver Trust (SLV) was up 2% in premarket trading and is on track to open at its highest levels.

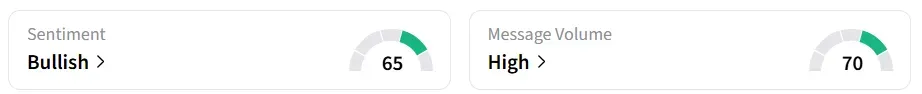

Retail sentiment for SLV on the platform remained ‘bullish’ amid ‘high’ message volumes.

Year-to-date, SLV has gained nearly 140%.

Eroding confidence in fiat currencies, stubborn inflation, and widening fiscal deficits pushed investors toward hard assets, with silver benefiting as a cheaper, more volatile alternative to gold despite strong central bank buying of bullion.

At the same time, electrification, solar expansion, EV growth, and data-center build-outs lifted industrial demand, while years of limited mine supply kept the physical silver market tight.

Gold Jumps To Record Highs

Gold prices surged to all-time highs, with spot gold (XAUUSD) rising to $4,497.69 an ounce, while Gold futures for February 2026 deliveries gaining 1% to $4,515.2 an ounce.

Yardeni Research warned that an overly stimulative mix of U.S. monetary and fiscal policy could pressure bond yields, prompting it to raise its year-end 2026 gold target to $6,000 an ounce.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)