Advertisement|Remove ads.

Starbucks Gets Price Target Raise From Citi, But Retail’s Not Excited Yet

Citigroup has raised its price target on Starbucks (SBUX) shares by $5 to $100 on Monday, citing that the coffee giant is positioned to report at least in-line U.S. same-store sales.

Starbucks shares were down 1.2% in premarket trading on Monday morning.

Citigroup also maintained its ‘Neutral’ rating on Starbucks as part of the company’s third-quarter earnings preview.

Starbucks is currently undergoing a turnaround with new CEO Brian Niccol attempting to steer the company back to its roots as a coffee house. He has initiated a revival in its U.S. coffeehouse heritage with streamlined menus, refills, enhanced condiment stations, and café wait times trimmed to under four minutes.

Niccol is credited with doubling revenue at Chipotle Mexican Grill (CMG) under his leadership.

However, he faces a stiff challenge in his new role, given that Starbucks' sales in the United States continue to lag. The company has reportedly been testing protein drinks as part of its menu changes to appeal to a broad audience and boost sales.

Starbucks is expected to post third-quarter net revenue of $9.30 billion, a 0.6% rise compared to a year ago, and adjusted profit per share of $0.67, according to data compiled by FinChat.

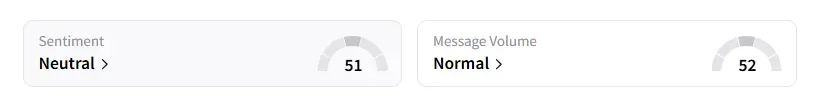

Retail sentiment on the stock dipped into the ‘neutral’ territory from ‘bullish’ a day ago, according to Stocktwits data.

Last week, CNBC reported that Starbucks had attracted offers for a potential stake sale, valuing the coffee chain unit at up to $10 billion. The China business has been a focus point for Niccol, who is aiming to open thousands of new stores in the country, building on the existing footprint of over 7,000 locations.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Kenvue CEO Thibaut Mongon Steps Down, Director Kirk Perry To Take On Interim CEO Role

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_elonmusk_OG_jpg_0752af8e37.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_old_White_House_c2cba4ca94.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Space_X_Elon_Musk_jpg_b27208e213.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_model_y_jpg_2fd46dbfb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_humana_resized_jpg_e2c016ee03.webp)