Advertisement|Remove ads.

Starbucks, P&G Line Up Earnings, Retail Investors Brace For The Consumer Pulse Check

Starbucks and Procter & Gamble are set to report earnings next week, with retail investors closely watching the results to gauge momentum in the restaurant and consumer goods sectors, respectively, as the two bellwethers are expected to shape sentiment across the broader consumer landscape.

Here’s how retail investors are positioning themselves heading into next week:

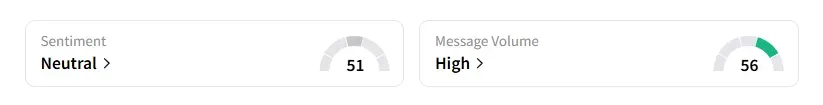

1. Starbucks (SBUX): Retail sentiment on Starbucks remained unchanged in the ‘neutral’ territory with chatter at a ‘high’ level, according to data from Stocktwits.

Shares of Starbucks were down marginally during midday trading on Friday and have gained over 2% year-to-date.

Last week, Jefferies analyst Andy Barish downgraded Starbucks to ‘Underperform’ from ‘Hold’ and maintained a price target of $76, according to TheFly.

Barish added that Starbucks' operational issues could take longer than expected to resolve, and the company's investments are weighing on its earnings.

The coffee chain, which is expected to post earnings on Tuesday, is undergoing an overhaul under CEO Brian Niccol, who has implemented the “Back to Starbucks” plan, aimed at reviving the heritage coffeehouse culture.

Starbucks is expected to post net revenue of $9.31 billion, a 0.6% rise year-over-year, and profit per share of $0.64, according to data compiled by Fiscal AI.

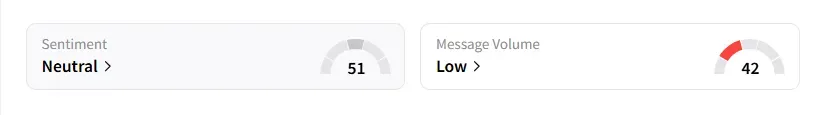

2. Procter & Gamble (PG): Retail sentiment on the stock improved to ‘neutral’ from ‘bearish’ a day ago, with message volumes at ‘low’ levels, according to Stocktwits data.

Shares of P&G were down nearly 1% and have fallen over 6% so far this year.

Earlier on Friday, JPMorgan downgraded P&G to ‘Neutral’ from ‘Overweight’ and cut its price target to $170 from $178. The brokerage expects the company to report "another lackluster quarter" and normalization of category growth.

Lower-income consumers in developing markets are more cautious, and P&G is more dependent on those markets relative to emerging markets, JPMorgan added.

A bullish Stocktwits user predicted that the stock could reach $180 following the earnings report on Tuesday.

In June, the company announced plans to eliminate 7,000 jobs over two years and streamline its portfolio by exiting select brands and categories in key markets. The restructuring reflects ongoing challenges from U.S. tariffs and shifting consumer demand.

P&G had earlier said that it would raise prices on some products to offset the impact of tariffs.

It is expected to report fourth-quarter total revenue of $20.79 billion, a 0.3% increase from the same period last year, and profit per share of $1.42.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Advance Auto Parts Faces Retail Skepticism Even As Wall Street Cheers $1.5B Debt Offering

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)