Advertisement|Remove ads.

Hims & Hers CEO Bets On Personalized Healthcare And AI In 2026 — Wall Street Braces For A Costly Year

- Dudum said individuals are taking greater control of care through DTC access, preventive health, and wider use of AI.

- BofA and Citi cut targets, citing margin pressure and a heavy investment outlook for 2026.

- Novo’s broader rollout of oral Wegovy intensified competition in the GLP-1 market.

Hims & Hers Health CEO Andrew Dudum said the company is leaning into a consumer-led healthcare model in 2026, even as Wall Street grows more cautious about margins and near-term earnings pressure.

Dudum Sees AI As Key Focus

In a blog post on Thursday, Dudum said healthcare is moving toward personalized models that give individuals greater control over their care. He pointed to the growing role of direct-to-consumer channels, a rising emphasis on preventive and longevity-focused care, and broader use of AI to improve access and personalization.

He said there is a growing demand for easier access, lower prices and more personalized care, as well as heightened interest in early testing, diagnostics and continuous health tracking. Dudum added that AI is also being used to minimize friction in care delivery and enable more reliable engagement between consumers and providers.

OpenAI Pushes Into Healthcare

The development comes as large technology platforms increase their presence in healthcare. OpenAI on Wednesday launched ChatGPT Health, which helps users blend health information with AI-driven insights.

OpenAI said users can connect their electronic health records and fitness apps, such as Apple Health, Function and MyFitnessPal, securely to have ChatGPT help them make sense of test results and guide their health regimens in light of personal trends. The company said ChatGPT Health was developed over two years in collaboration with more than 260 physicians.

Wall Street Turns Cautious

On Thursday, Bank of America Securities (BofA) lowered its price target on Hims & Hers to $29 from $32 and maintained an 'Underperform' rating, saying expectations for 2026 appear too optimistic.

The firm said consensus forecasts for sales and earnings before interest, taxes, depreciation, and amortization (EBITDA) margins are elevated, describing 2026 as a “big investment year” for the company. BofA added that it sees downside risk to 2026 revenue and margins, with negative earnings revisions likely in the coming months.

Citigroup also maintained a ‘Sell’ rating with a $30 price target, pointing to competitive pressures following a move by Novo Nordisk, which said its oral Wegovy pill is now broadly available in the U.S., with prices starting at $149 a month for certain doses and as low as $25 for some commercially insured patients.

Citi noted that Hims was again excluded from Novo’s list of partners, which includes CVS Health, Costco, LifeMD and GoodRx, likely reflecting disagreements around Hims’ compounded semaglutide strategy. The firm added that broader access to oral Wegovy could weigh on Hims’ GLP-1 offering this year.

How Did Stocktwits Users React?

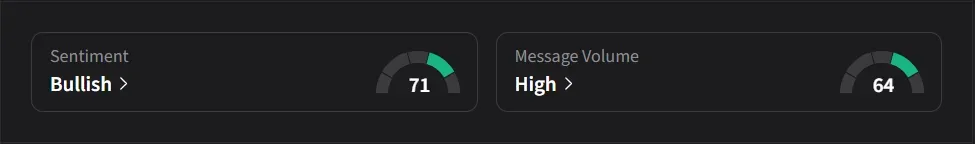

On Stocktwits, retail sentiment for Hims was ‘bullish’ amid ‘high’ message volume.

Hims’ stock has risen 32% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)