Advertisement|Remove ads.

‘Built To Outperform Bitcoin’: Strategy CEO Defends $90 Million Bitcoin Buying During Sell-Off

- Strategy CEO Phong Le said the company’s Bitcoin buying is driven by a long-term plan to outperform Bitcoin, not short-term price moves.

- Michael Saylor disclosed that Strategy bought 1,142 Bitcoin for about $90 million, lifting total holdings to 714,644 Bitcoin.

- Strategy’s leadership argues that accounting losses do not reflect real cash losses and that increasing Bitcoin per share remains the firm’s key focus.

As Bitcoin slid earlier this month, Strategy did the opposite of what many investors expected. Phong Le, CEO of Strategy, said the company had decided to buy more than $90 million worth of Bitcoin (BTC) during last week’s market sell-off, as it reflected the firm’s long-term belief that Strategy has been built to outperform Bitcoin on Tuesday.

In a Fox Business interview, Le stated that Strategy added 1,142 Bitcoin at an average price of $78,815 per coin, even as Bitcoin dropped sharply earlier this month. “Strategy is built to outperform Bitcoin as long as we continue to buy Bitcoin and issue credit,” Le said. He added that investors should not judge the company on short-term price swings, saying, “You have to have a long time horizon with Bitcoin, with Strategy.”

‘Amplified Bitcoin’: How Strategy Frames Its Capital Model

Le also shared later that Strategy treats Bitcoin as “Digital Capital” and the Variable Rate Series A Perpetual "Stretch" Preferred Stock (STRC) is “Digital Credit.” He positioned the recent purchase as a part of a broader capital strategy rather than a reactionary trade, adding, “Strategy is Amplified Bitcoin.”

When asked whether investors have raised concerns about the company’s Bitcoin purchases, Le stated, “Stretch is digital credit. We created something last year that provides 11% dividend yields, cash paid monthly, and is tax-deferred,” referring to Strategy’s capital structure that is designed to support ongoing Bitcoin buying.

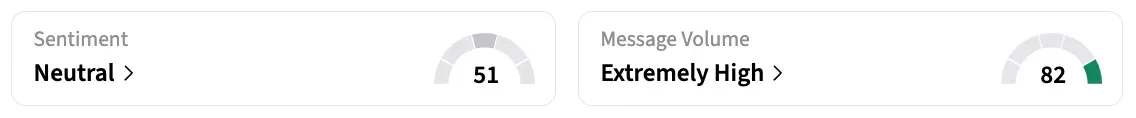

Strategy Inc (MSTR) traded at around $133.36, down by 3.67% in the last 24 hours. On Stocktwits, the retail sentiment around Bitcoin remained in the ‘neutral’ territory, with chatter at ‘extremely high’ levels over the past day.

Saylor Reinforces Strategy’s Bitcoin Thesis

Le’s comments came as Michael Saylor, founder and chairman of Strategy, disclosed the Bitcoin acquisition done on Monday, saying Strategy had bought 1,142 BTC for about $90 million, bringing total holdings to 714,644 BTC. Saylor added that the company has now invested roughly $54.35 billion into Bitcoin at an average price of $76,056 per coin and linked the company’s acquisition filing detailing the purchase.

Saylor later highlighted a long-term, annualized return across assets that showed Strategy’s stock alongside Bitcoin and major equities, serving as visual evidence supporting the company’s claim that its Bitcoin-focused model can outperform traditional investments over the long term.

Read also: Bitcoin Is Trading Like An ‘Overheated Big Tech Stock’ And Not ‘Digital Gold’, Stifel’s Bannister Warns

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tilray_logo_resized_c5047aab55.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)