Advertisement|Remove ads.

Strategy Taps $4.2B In Preferred Shares To Buy More Bitcoin: Retail’s Exuberant

Strategy (MSTR) on Monday announced a new At-The-Market (ATM) program enabling the incremental sale of up to $4.2 billion in its 10.00% Series A Perpetual Stride Preferred Stock (par value $0.001).

The company plans to issue and sell the STRD shares gradually, guided by prevailing market conditions, including price and volume.

Strategy stock inched 0.6% lower in Monday afternoon trading, following the news, amid broader market weakness after U.S. President Donald Trump announced 25% tariffs on South Korea and Japan.

Bitcoin traded at $107,662.40, a 1.4% decline in the last 24 hours.

The company said net proceeds from the stock sale will support general corporate activities, including acquisitions of Bitcoin, working capital needs, and potential dividend payments on both Strategy’s 10.00% Series A Stride and 8.00% Series A Strike Preferred Stocks.

By leveraging the flexible capital raising mechanism, the company can tap into its preferred equity base for strategic and operational flexibility without issuing traditional debt.

Michael Saylor-backed enterprise reported an unrealized profit of approximately $14.05 billion in the second-quarter (Q2), driven by both Bitcoin’s recent price surge and new accounting rule, according to a filing.

This is the first week since April that the firm, formerly known as MicroStrategy, did not acquire additional Bitcoin. With roughly $65 billion worth of holdings, Strategy remains the largest publicly traded holder of the cryptocurrency.

Saylor has reshaped the former enterprise software company into a highly leveraged vehicle for Bitcoin exposure by issuing both equity and debt. During Q2, Strategy bought approximately $6.8 billion worth of the cryptocurrency, according to the report.

The company has achieved a 19.7% BTC Yield, placing it roughly 80% of the way toward the full-year goal of 25% by mid-year.

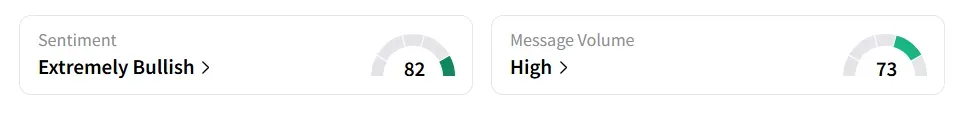

On Stocktwits, retail sentiment toward Strategy remained in ‘extremely bullish’ territory with ‘high’ message volume levels.

Strategy stock has gained over 38% in 2025 and has more than tripled in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)