Advertisement|Remove ads.

Subdued Q1 Does Not Deter Asian Paints Stock: SEBI RA Sees 30% Upside On Breakout

Asian Paints reported a 6% drop in net profit of ₹1,100 crore for Q1 FY26 on Tuesday, broadly in line with street estimates. Revenue from operations declined slightly to ₹8,939 crore, hurt by a subdued demand environment due to macro-economic uncertainties and the early onset of monsoons.

Despite the muted results, Asian Paints shares closed 1.8% higher on Tuesday and is currently up 1.64% to ₹2,440.90.

Q1 Earnings Fineprint

Despite 3.9% volume growth in the decorative paints segment, value growth remained sluggish due to price reductions, subdued rural demand, and the absence of festive tailwinds, said Sanyam Vaish, a SEBI-registered analyst at Finpire Capital Research.

EBITDA margin held steady at 18.2%, showing cost control but limited operating leverage.

While urban demand has started to recover, management acknowledged weakness in Tier-2 and Tier-3 markets. CEO Amit Syngle reiterated the company’s commitment to brand building and innovation, even as market dynamics shift rapidly.

Stock Outlook

Technically, Asian Paints continues to trade sideways, with price action locked in a range of ₹2,300 to ₹2,600 for over five months, said Vaish.

At the current market price, momentum indicators remain indecisive. The moving average convergence/divergence (MACD) is in the negative zone but flattening, while the relative strength index (RSI) is hovering around 55, suggesting a neutral stance, Vaish said.

Key support lies at ₹2,300, and a breakout above ₹2,550 could trigger a swift rally toward ₹3,100, offering up to a 30% potential upside, he added.

For short-term traders, the ₹2,390 - ₹2,410 zone offers a potential entry point, with a stop-loss at ₹2,280 and upside targets at ₹2,550 and ₹3,100.

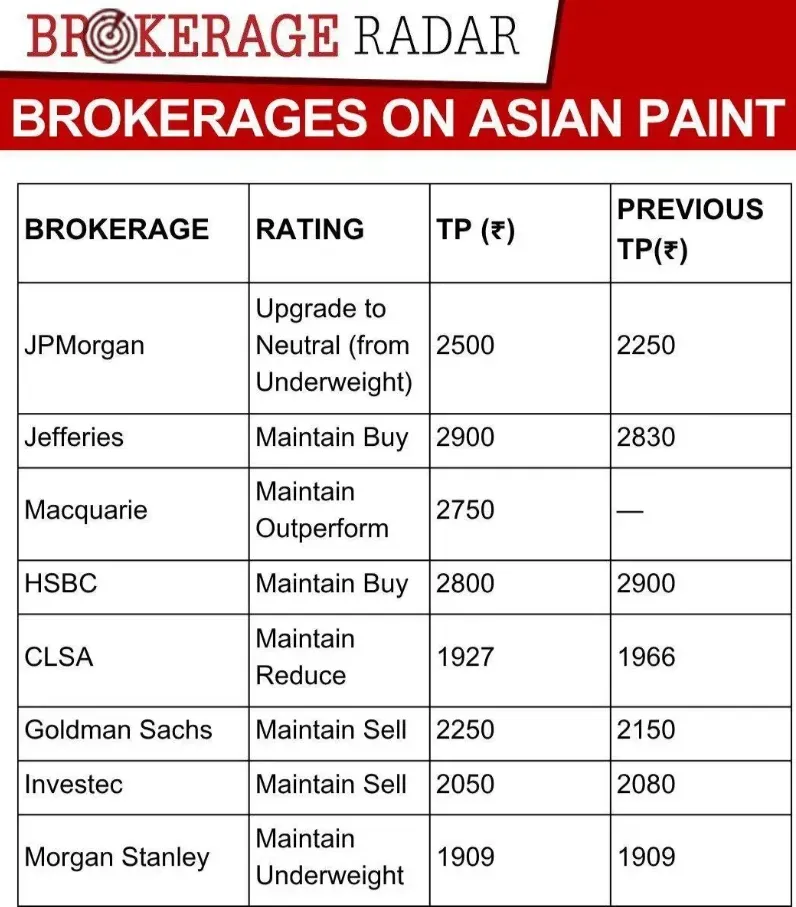

Brokerage Radar

Source: Wealth Guru

Competition Concerns

A key concern is intensifying competition, especially from Birla Opus, which has captured a 6.8% market share within a year. Asian Paints’ own share has declined from 59% to around 52%, the analyst noted.

Earlier this month, Birla Opus filed an antitrust complaint against Asian Paints with the Competition Commission of India, alleging abuse of market dominance. The complaint claims Asian Paints pressured retailers not to stock Birla Opus products. Asian Paints is seeking to quash an antitrust inquiry.

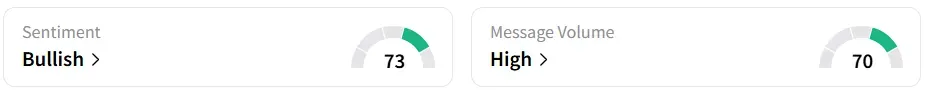

Retail sentiment on Stocktwits shifted to ‘bullish’ from ‘bearish’ a day earlier, amid ‘high’ message volumes.

Year-to-date, the stock has climbed 6.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)