Advertisement|Remove ads.

Sunnova Energy Set To Lose Half Its Market Cap As Cash Crunch Readies Stock For Worst Single-Day Performace – Retail Eyes Reverse Split

Sunnova Energy International (NOVA) tumbled more than 53% in pre-market trading Monday, poised to hit a fresh all-time low, after the company warned about its liquidity woes in its fourth-quarter earnings report.

If pre-market losses sustain, the stock is set to register its worst single-day performance, according to Koyfin data.

The residential solar provider said its unrestricted cash, operating cash flows, and existing financing agreements were “not sufficient to meet obligations and fund operations.”

The company has hired a financial advisor to help with debt management and refinancing efforts, outlining steps in its latest Form 10-K filing.

“We have a solid plan,” said CEO John Berger during the earnings call.

While revenue for the fourth quarter (Q4) climbed 15% year-over-year (YoY) to $224 million, it fell short of analysts’ estimates of $236 million, according to Koyfin data.

Sunnova reported a net loss of $127.7 million for the quarter.

For the full year, revenue increased 16.6% to $839.92 million, up from $720.65 million in 2023.

Berger said on the earnings call that Sunnova may have to raise prices again to “protect margins” as the industry struggles with diminishing returns.

The company recently cut 15% of its workforce to conserve cash, expecting the move to yield about $35 million in savings.

Management attributed Sunnova’s struggles to high interest rates and lower state incentives, making it more expensive for consumers to buy the company’s home solar equipment.

Adding to concerns, the Trump administration and U.S. Congress are weighing cuts to federal solar tax credits, a key revenue source for the company.

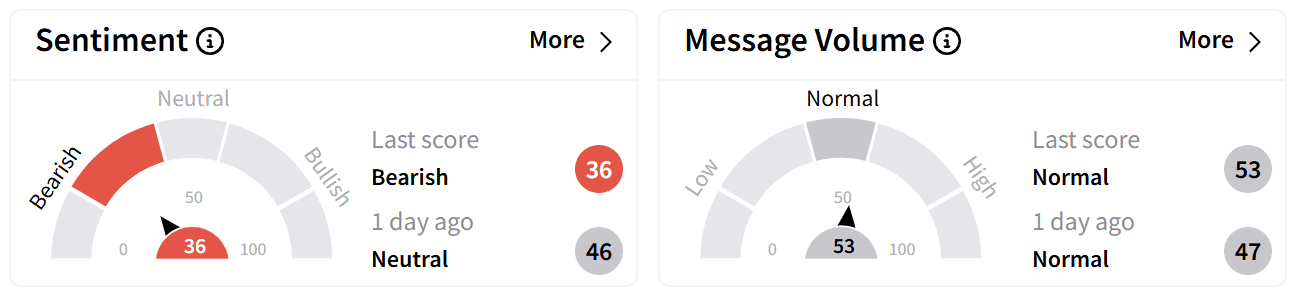

Retail sentiment on Stocktwits around Sunnova’s stock dipped to ‘bearish’ from ‘neutral’ a day ago.

Some traders speculated on a potential reverse stock split as shares dipped below $1 in pre-market trading, while others argued that the selloff was an overreaction.

Sunnova shares have plunged 76% over the past year and are down 52.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)