Advertisement|Remove ads.

Super Micro Stock Drops On $2B Convertible Bond Deal Plan, But Retail Turns Bullish

Super Micro Computer Inc.(SMCI) shares traded over 7% lower on Monday after the company announced plans to issue up to $2 billion in convertible senior notes maturing in 2030.

The offering targets qualified institutional buyers under Rule 144A and may include an additional $300 million in notes if initial investors exercise their purchase option within 13 days of the initial offering.

Super Micro will issue unsecured debt that pays interest semi-annually, carrying senior status on the balance sheet.

The bonds will mature on June 15, 2030, unless converted or redeemed earlier, and will only be convertible under specified conditions until December 17, 2029. After that date, holders can convert at any time before maturity.

The company retains the flexibility to settle conversions with cash, stock, or a mix of both. Terms, including conversion price and interest rate, will be set when the deal is priced in coordination with initial buyers.

To mitigate dilution, Super Micro plans to enter into capped call agreements with banks tied to the convertible notes. These derivatives aim to offset possible cash payouts or share dilution.

Proceeds from the issuance will partly fund the cost of hedging transactions. Additionally, up to $200 million will be used to repurchase common shares concurrently through private transactions.

The remainder will support general corporate needs, including working capital and expansion. If the $300 million option is exercised, additional proceeds will similarly cover hedging costs.

Super Micro Computer recently said that it is broadening its lineup of offerings tailored for Nvidia Corp.(NVDA) Blackwell Architecture to serve customers in Europe.

The company, known for its AI-focused server infrastructure, has rolled out more than 30 integrated systems optimized for Nvidia's HGX B200, GB200 NVL72, and RTX PRO 6000 Blackwell Server Edition.

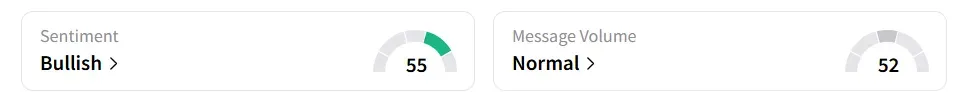

On Stocktwits, retail sentiment around Super Micro improved to ‘bullish’ from ‘neutral’ the previous day.

Super Micro stock has gained over 37% year-to-date and has lost over 49% in the last 12 months.

Also See: Rezolve Ai To Be Added To Russell Indices After Revenue Surge: Retail Echoes Confidence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_OG_jpg_67b04c304a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dc9a399d51.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sable_offshore_jpg_81d3c0b91f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)