Advertisement|Remove ads.

Target Stock Plummets To 5-Year Low After Analysts Slash Ratings On Tariff Anxiety: Retail Still Has Hopes

Target Corp (TGT) shares fell 6% on Tuesday to their lowest levels since the initial COVID-19 lockdowns after several analysts lowered their expectations on the stock.

Wall Street brokerages are growing more cautious about retail businesses, particularly those selling discretionary items like electronics and fashion, amid concerns over the impact of new U.S. tariffs.

According to MT Newswires, Evercore slashed its price target on Target shares to $100 from $120 on Tuesday, and Truist Securities lowered its expectation to $82 from $124.

They maintained hold and in-line ratings, respectively.

Last week, Braid downgraded the shares to 'Neutral' from 'Outperform' and slashed the price target to $110 from $145.

The revisions also consider Target's disappointing earnings report from last month.

The retail store chain had forecasted annual comparable store sales below expectations. According to management, the guidance did not include the impact of tariffs and was weighed by consumer softness.

Currently, 22 of 37 recommend 'hold' and 14 suggest 'Buy' or higher, according to Koyfin data. Their average price target is $133.97.

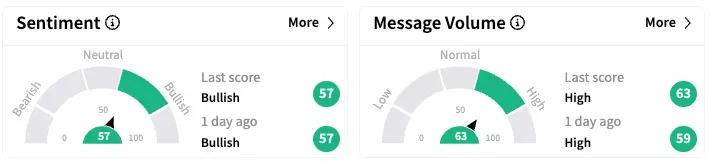

On Stocktwits, retail sentiment was in the 'bullish' territory, and message volumes were high, unchanged from a day ago.

One user said the analyst's actions deflated a nascent moment that was building up in the shares.

One user said the company might accelerate buybacks given the weakness in shares.

TGT stock is down 34.3% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)