Advertisement|Remove ads.

Tata Chemicals Overvalued? SEBI RA Warns Of Downside Risk Ahead Of Q1 Results

Tata Chemical shares traded 2% lower on Friday ahead of its June quarter earnings report.

SEBI-registered analyst Deepak Pal highlighted that this pre-result correction may signal further downside pressure, especially as the stock currently appears to be trading in the overvalued zone.

The Relative Strength Index (RSI) is hovering around 55, and the Moving Average Convergence Divergence (MACD) is slightly below the signal line, indicating weakening momentum. The weakness in the last session altered the short-term trend, and volatility is expected around the results, according to Pal.

On its technical charts, Tata Chemicals has seen strong support from its 14-day and 55-day Exponential Moving Averages (EMAs) on the daily chart, as well as near ₹900 and the 14-day EMA on the weekly chart.

For short-term traders, Pal suggests that levels near ₹990 could act as immediate resistance, and a sell position can be considered with a stop loss around that level.

However, for long-term investors, the stock may be a good buy on dips with a stop loss of ₹850.

If the results turn out positive, Tata Chemicals may resume its upward trend and potentially test levels of ₹1,100–₹1,150 in the coming weeks, but he cautioned that this would require a long-term perspective.

On the fundamentals, despite its strong positioning, the company's financial performance has been relatively weak lately. It has shown low profitability with a return on equity (RoE) of 1.6% and return on capital employed (RoCE) of 3.5%. Its price-to-earnings ratio is high, ranging from 88 to 105.

However, the company has maintained decent free cash flow and a manageable debt profile.

Pal concluded that the stock appeared overvalued based on earnings, and recent pressures in the soda ash market (especially in Europe) have impacted margins. While it has long-term potential due to its global presence and diversification, current valuations suggest that investors should remain cautious or wait for a more favorable entry point.

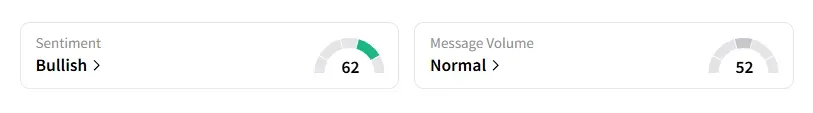

However, data on Stocktwits shows that retail sentiment has remained ‘bullish’ on this counter for a week.

Tata Chemicals shares have declined nearly 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)