Advertisement|Remove ads.

Tata Motors: Can Harrier EV Revive Sales? SEBI RA Weighs In On The Road Ahead

Tata Motors unveiled its new electric car on Tuesday – Tata Harrier EV, an electric SUV boasting a range of up to 456 km per charge and an expected price between ₹26-32 lakhs.

SEBI-registered analyst Finance with Palak notes that the stock price has risen nearly 10% in the last month, fueled partly by the unveiling of the new Harrier EV.

However, its momentum was tempered by the recent May sales data announced this week. Tata Motors lost its 3rd position in monthly car sales to Hyundai, selling 43,130 units vs 44,875 units by Hyundai.

Tata Motors’ market share also reduced to 10.9% from 11.4% in April. Overall domestic sales fell 10% year-on-year, and passenger vehicle sales declined 11% in May.

From a technical perspective, she sees support below ₹700, with a breach below this level signalling a 3% fall.

On the upside, Palak notes resistance at ₹723; a breakout above this could trigger a 4% rally.

She adds that the short-term charts show an inverse parabolic move, hinting at a likely downturn over the next few days. Still, the medium-term outlook remains bullish, especially with the Harrier EV launch expected to drive a 5-7% recovery.

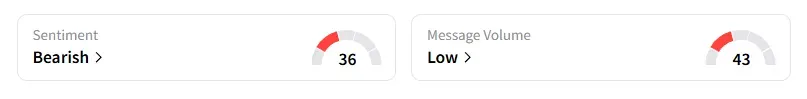

However, data on Stocktwits shows that retail sentiment has remained ‘bearish’ on this counter since May.

Tata Motors’ shares have fallen 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)