Advertisement|Remove ads.

Tata Motors Under Pressure Before Earnings: SEBI RA Deepak Pal Flags Support At ₹640

Tata Motors shares fell on Friday ahead of reporting its June quarter (Q1 FY26) earnings. Investors will be watching for its British unit Jaguar Land Rover (JLR) margins, electric vehicle (EV) volumes, and management commentary on the road ahead amid geopolitical headwinds.

Analysts expect a subdued quarter with a drop in revenues, margins, and volumes, as well as weakness in the passenger vehicle business and JLR. According to Kotak Equities, JLR revenues (excluding China JV) are likely to decline 16% year-on-year, driven by a 12% fall in volumes.

In July, the automaker had reported a 6% drop in overall domestic auto sales to 65,953 units in July 2025. However, it marked a milestone with its highest-ever monthly EV sales.

SEBI-registered analyst Deepak Pal noted that Tata Motors’ technical charts were flagging a bearish sentiment.

Technical Outlook

Tata Motors is currently showing technical weakness on the daily chart, with the price trading below key 20, 50, and 100-day Exponential Moving Averages (EMAs), indicating strong bearish sentiment.

Other indicators, such as the Parabolic SAR and MACD are both showing continued downward pressure, while its Relative Strength Index (RSI) at 35.63 signals near-oversold conditions but no clear reversal.

Pal identified support around ₹640–₹630, with resistance at ₹665–₹675.

He believes that Tata Motors remains a strong bet fundamentally in the long term, driven by JLR recovery, the growing EV segment, and steady domestic passenger and commercial vehicle sales.

However, he cautioned that recent margin pressures from global macro factors, tariff concerns, and forex volatility were a concern.

Tata Motors Shares: What Should Investors Do?

He concluded that overall macros remain mixed with weak global cues and rate hike fears weighing on sentiment, even as domestic demand and government EV policies offer structural support.

While the near-term outlook remains cautious, long-term investors may consider accumulating on dips, according to Pal.

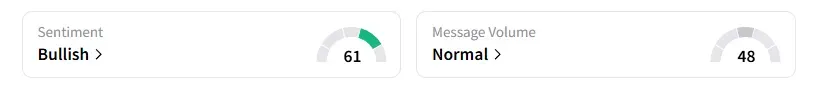

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter.

Tata Motors shares have declined 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)