Advertisement|Remove ads.

India Channels Trump’s Tariff Playbook With ‘Safeguard’ Duty On Steel: Tata Steel, Hindalco, SAIL Stocks Rally

India's metal sector is riding a wave of investor optimism as government intervention to protect domestic producers has sparked a rally in stocks linked to the industry.

On Tuesday, the Nifty Metal index extended its gaining streak, hitting 8,702 in early trade. The index has gained nearly 7% in the last five days.

Key players like Tata Steel, Hindalco, SAIL, and JSW Steel led the charge, posting gains of 1%–2%.

The trigger is the Indian government's decision to impose a 12% safeguard duty on certain steel imports.

This move is seen as a protective measure to shield domestic steel manufacturers from the adverse impact of cheaper imports, particularly from countries with surplus capacity and aggressive export strategies like China, South Korea.

The duty will be in effect for 200 days starting Monday and may be revoked, superseded, or amended prior to the 200-day duration.

India's decision comes amid a shift in global trade dynamics and follows the Trump administration's imposition of widespread tariffs on various countries in early April, marking the beginning of a trade war with China.

Washington's proposed tariff increases on Chinese steel and aluminum imports have been met with criticism from Beijing and could potentially result in retaliatory measures.

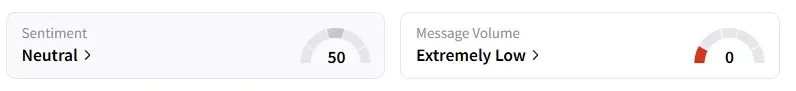

Data on Stocktwits, however, indicates that retail sentiment on the metal index remains 'neutral.'

Nifty Metal Index remains flattish, up 0.6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)