Advertisement|Remove ads.

Teladoc’s $65M Catapult Health Deal Wins Over Retail As Stock Eyes Best Day In Over 2 Months

Teladoc Health Inc. shares surged 7% on Wednesday, reaching one-month highs and tracking their best single-day gain since Nov. 25, as investors cheered its deal to buy Catapult Health.

The company said it would acquire Catapult, a leading virtual preventive care provider, in an all-cash deal worth $65 million, with an additional $5 million contingent earnout.

As of the third quarter of 2024, Catapult generated $30 million in trailing twelve-month revenue, and Teladoc aims to integrate its at-home diagnostic testing and clinical support into its platform.

The deal is expected to close in the first quarter of this year, pending regulatory approvals.

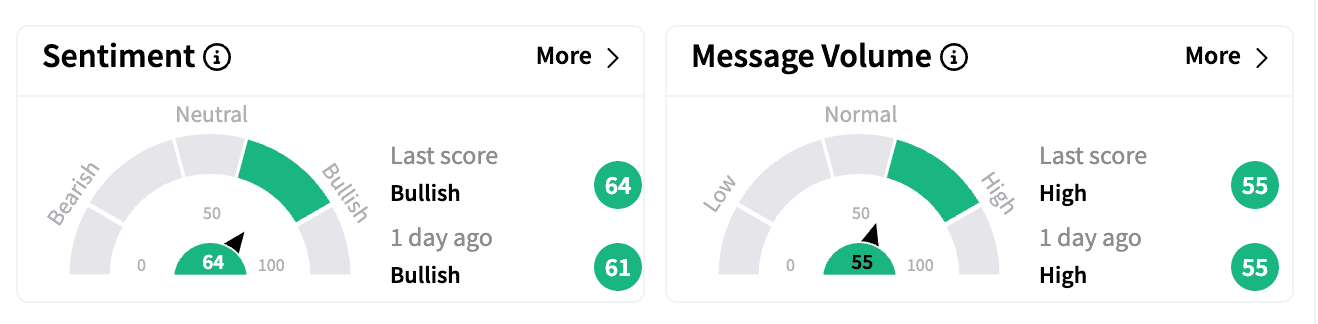

On Stocktwits, sentiment for Teladoc, which has nearly 40,000 followers, became increasingly bullish as message volume spiked.

One user called Teladoc “undervalued,” while another described the acquisition as “a point of inflection” for the company.

The announcement comes just weeks before Teladoc’s fourth-quarter earnings report, where Wall Street expects an adjusted loss per share of $0.23 on revenue of $639.55 million.

Teladoc boomed during the COVID-19 pandemic but has since struggled amid rising competition and weaker financials. Following the ouster of CEO Jason Gorevic last year, the company has been trying to chart a recovery path.

Despite Wednesday’s rally, Teladoc remains over 95% below its pandemic-era all-time high.

The stock has gained 18% year-to-date in 2025, with a current short interest of 13.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)