Advertisement|Remove ads.

Teck–Anglo American $53B Merger Branded An 'Incredible Opportunity' For Canada By British Columbia Premier

The merger of Teck Resources and Anglo American Plc is an “incredible opportunity” the Canadian government should consider, the Premier of British Columbia province reportedly said.

According to Bloomberg News, David Eby, the top leader of Teck’s home province, said the commitments made by the two companies to keep the combined firm headquartered in Vancouver and further investments in Canadian projects constitute a “home run.”

Teck and Anglo American agreed to merge earlier this week to create a $53 billion mining giant. However, the deal will be the subject of intense scrutiny by the Canadian administration as copper, the element at the center of the agreement, is considered a critical mineral.

“It’s an incredible opportunity for British Columbia and Canada, and I’ll be delivering that message directly to the federal government as they do their assessment of this bid,” Eby reportedly stated.

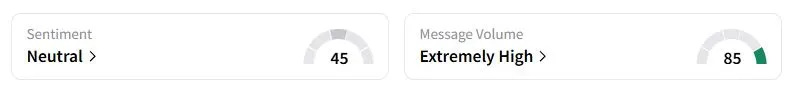

Retail sentiment on Stocktwits about Teck was in the ‘neutral’ territory at the time of writing.

Last year, Ottawa amended the Investment Canada Act, which has tightened the rules of foreign investment in Canadian firms considered critical to national security. Canadian Minister Melanie Joly said earlier this week that while she welcomes foreign investment in Canada, the federal government will carefully evaluate several aspects of the agreement before greenlighting it.

Eby, the leader of the left-leaning New Democratic Party, also warned other companies that may be looking at mounting any rival bids. “I just would caution other companies that are looking at this — Canada and British Columbia are committed to developing our metals and minerals in our province and in our country, and Teck is a key part of that,” Eby reportedly said.

The two companies expect to close the deal during the next 12 to 18 months. During a call with analysts, Teck CEO Jonathan Price said the company’s pledges to keep its head office in Vancouver will remain in place “in perpetuity.”

Also See: UBS Chief Ermotti Warns ‘Unclear’ US Tariff Impact Clouding Fed Policy Outlook

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)