Advertisement|Remove ads.

Teladoc Health Faces Investor Wrath After It Withdraws Outlook: Here’s What Happened

Teladoc Health shares plunged over 8% on Thursday after the telemedicine firm withdrew its full-year 2024 financial outlook for its consolidated operations and its BetterHelp segment, last provided in April. The company also withdrew its three year outlook for its consolidated operations and its operating segments.

Teladoc’s second-quarter results failed to meet analyst expectations with revenue coming in at $642.44 million versus an estimate of $649.70 million and earnings per share (EPS) loss of $4.92 versus an estimated loss of $0.35.

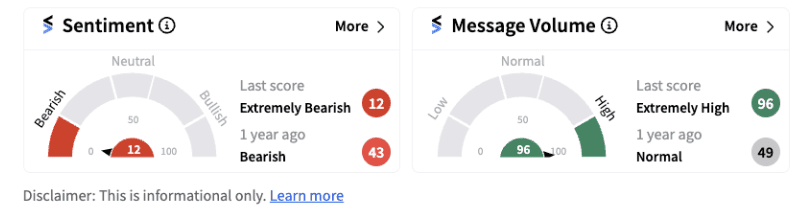

Driving the net loss of $837.67 million was a goodwill impairment charge of $790 million. Following the announcement, retail investors came down heavily on the stock with sentiment falling into ‘extremely bearish’ territory (12/100) from its previously ‘bearish’ zone.

Chuck Divita, Chief Executive Officer of Teladoc Health said that although the Integrated Care segment did well, continued headwinds in the BetterHelp segment impacted the overall results.

Teladoc Health Integrated Care segment revenue rose 5% to $377.42 million. The segment experienced some traction during the quarter with adjusted operating income rising 69% year-over-year (YoY) to $64.03 million. Adjusted operating margin improved significantly by 642 basis points to 17% during the quarter.

However, the firm’s BetterHelp’s mental health platform that it acquired in 2015 faced headwinds. Revenue fell 9% to $265 million and the segment saw a 26% decline in its adjusted operating income of $25.45 million. Its operating margin also fell by 209 basis points to 9.60%. Not surprisingly, it was a hot topic of discussion during the company’s earnings call.

Mala Murthy, chief financial officer at Teladoc, reportedly clarified that for BetterHelp, customer acquisition costs have continued to trend higher over the past few quarters. “…there is limited visibility on the near term path, which as we have discussed, could be further affected by the unknown impact of the upcoming presidential election on ad pricing,” Murthy said.

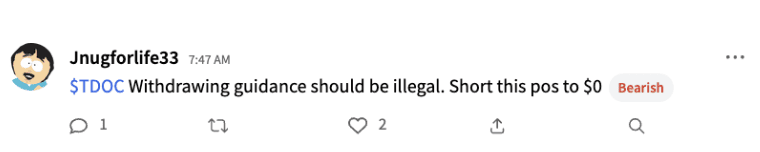

Notably, Teladoc’s shares have lost over 97% of their value since the highs seen in 2021. Retail investors aren’t happy with the firm’s withdrawal of its guidance, as it introduces further uncertainty to an already unclear situation.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)