Advertisement|Remove ads.

Datavault AI Raises 2026 Outlook Amid Surge In Tokenized Asset Deal Interests

- The company said the move could potentially represent trillions of dollars in asset value worldwide.

- The agreements could generate hundreds of millions in revenue tied to the deployment of Datavault’s agentic data tools.

- Datavault AI raised its financial outlook, forecasting 2026 revenue of at least $200 million.

Datavault AI Inc. (DVLT) raised its 2026 revenue guidance after announcing that more than a dozen governments and corporations are in active discussions with the company to use its patented data technology for tokenizing real-world assets (RWA).

The company said the move could potentially represent trillions of dollars in asset value worldwide.

Financial Outlook

Datavault revealed that several of these negotiations have progressed to the executable contract stage involving multi-million-dollar upfront fees, performance milestones, and potential profit-sharing arrangements. These agreements could generate hundreds of millions in revenue tied to the deployment of Datavault’s agentic data tools, including DataValue and DataScore.

On the strength of these negotiations, Datavault AI raised its financial outlook, forecasting 2025 revenue to exceed $30 million and projecting at least $200 million in 2026, from the previous outlook of between $40 million and $50 million.

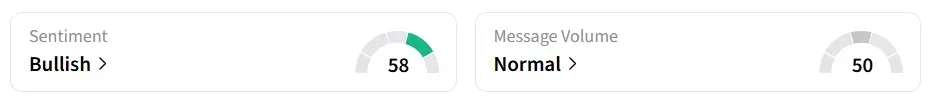

Datavault AI stock traded over 2% lower on Tuesday, after the morning bell. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels.

Broad Asset Scope

The company’s technology supports the tokenization of diverse real-world assets, including gold, silver, precious stones such as the Winsor Ruby, carbon credits, and rare earth elements, as well as agricultural and industrial commodities.

These RWA projects, currently in various stages of development, could generate short-term revenue in the tens of millions while opening up multi-billion-dollar opportunities in the long run.

Datavault’s ecosystem integrates three AI-driven products: Data Vault Bank, an IBM-backed Web 3.0 data asset engine; DataScore, a compliance and risk evaluation tool; and DataValue, a valuation algorithm that translates enterprise data into tradeable assets.

DVLT stock has declined by over 23% in 2025 and by more than 14% in the past 12 months.

Also See: Why Is Meta’s Yann LeCun In The Spotlight Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)