Advertisement|Remove ads.

Tellurian Shareholders Say Yes To Acquisition By Woodside, While Retail Says No With ‘Extremely Bearish’ Outlook

American natural gas company Tellurian Inc (TELL) announced on Friday its shareholders have approved the acquisition of the firm by Australian energy producer Woodside Energy Group (WDS).

In July, Tellurian had announced that Woodside will acquire all outstanding shares of the firm for $1 per share in an all-cash transaction.

Tellurian had stated that the acquisition price represented a 75% premium to its closing price on July 19, 2024, and a 48% premium to its 30-day volume weighted average price. According to the firm, the price reflected Driftwood LNG’s premier site, fully permitted status, advanced stage of pre-FID development and strong relationships with Bechtel, Baker Hughes, and Chart.

The implied total enterprise value of the transaction, including net debt, stood at approximately $1.2 billion.

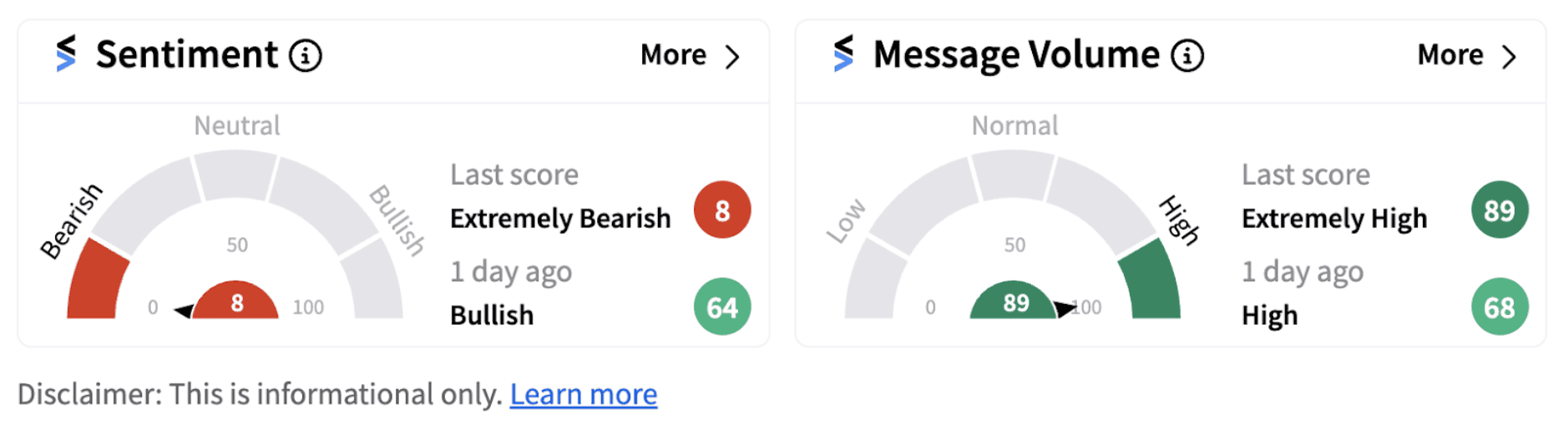

Following the development, retail sentiment on Stocktwits dipped into the ‘bearish territory’ as of 10:36 a.m. ET, accompanied by ‘extremely high’ message volumes (87/100).

Earlier this year, the board had recommended that shareholders accept Woodside’s offer, calling it the best outcome.

Executive chairman Martin Houston wrote in his letter to shareholders that the transaction delivered substantial and certain value and highlighted that the company’s situation necessitated an exploration of all possible alternatives, including a potential sale.

Notably, Tellurian is actively developing Driftwood LNG, an approximately 27.6 mtpa LNG export facility and associated pipeline network. Houston noted that Woodside’s partnership would be important in its bid to develop the facility.

“The board had to thoughtfully consider the risks and costs associated with continuing to develop Driftwood on our own versus other alternatives. Ultimately, we decided the attractive offer in hand outweighed the risks and uncertainty associated with going it alone,” he said.

Houston also noted that financing required to bring Driftwood into FID is contingent on commercial agreements with LNG buyers who may seek greater certainty from brownfield expansions or from project developers with larger balance sheets.

Another factor that led the board to decide in favor of the acquisition was the fact that while the equity and debt required to launch Driftwood was available, fewer equity capital providers were seeking development projects in the US.

“Equity providers are now less inclined to take risk ahead of projects being fully contracted. This makes the development process more sequential, and therefore extends the period over which we must self-fund,” the chairman had explained.

Shares of Tellurian have gained over 29% since the beginning of the year while NYSE-listed Woodside shares have lost over 14% during the period.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)