Advertisement|Remove ads.

Kenvue Seen As Attractive Buy By BofA After Stock Dip Following Report On Tylenol Autism Link

Bank of America stated that Kenvue (KVUE) is expected to be viewed as a “particularly attractive entry point” after the recent pullback in its stock following media reports that surfaced that Health Secretary Robert F. Kennedy Jr. intends to link prenatal use of its Tylenol drug to autism.

Analyst Anna Lizzul said that the company's new CEO and CFO took the opportunity in August to reset expectations at earnings and sees its lowered 2025 guidance as "achievable," according to TheFly.

Shares of Kenvue closed down 9.3% on Friday. Bank of America noted that given the current valuation discount to the average of household and personal care peers, the firm reiterates its ‘Buy’ rating and $25 price target as it sees a widening discount offering an attractive entry point.

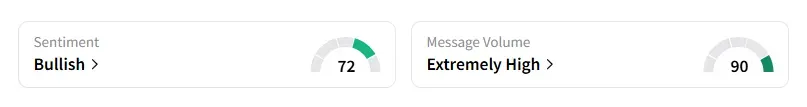

Retail sentiment on Kenvue dipped to ‘bullish’ from ‘extremely bullish’ territory a day ago, with message volumes at ‘extremely high’ levels, according to data from Stocktwits.

Evercore ISI lowered its price target on Kenvue to $23 from $25 and maintained an ‘In Line’ rating, reflecting lower peer valuations and the premium Tylenol commands within Kenvue's portfolio. The firm noted that the recent selloff in shares "might be overdone" when considering the lack of a proven causal link between Tylenol's active ingredient and neurodevelopmental disorders.

According to a report by The Wall Street Journal, in an upcoming Health Department report, there would be findings expected to link autism risk to low folate levels and Tylenol use during pregnancy.

Despite headline risks, a lack of definitive evidence linking Acetaminophen, the active ingredient in Tylenol, to autism may suggest limited long-term impact. Still, legal uncertainties could delay strategic moves, Evercore added.

Kenvue shares have declined nearly 13% this year and approximately 20% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: This Sportswear Giant Got Added To Jefferies’ Franchise Picks List – Find Out More

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_b98dced72d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_India_jpg_d0c2b87bd0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244386520_1_jpg_e364bca397.webp)