Advertisement|Remove ads.

Tesla Analysts Voice Concerns On Fundamentals, High Valuation

Tesla (TSLA) shares drew investor attention on Thursday after Wall Street analysts issued updates on their views on the stock.

On Thursday, BNP Paribas Exane analyst James Picariello initiated coverage of the EV maker with an ‘Underperform’ rating and $307 price target.

The new price target implies a potential downside of about 29% from Tesla’s closing price on Wednesday.

Tesla's two AI-led ventures – the Robotaxi and the Optimus business – generate zero sales today, but account for a majority of the firm's $1.02 trillion valuation, the analyst noted. However, he added that he takes an "optimistic view toward both."

BNP Paribas said that its base case assumption includes an active 2030 Robotaxi fleet of about 525,000 and 17 million cumulative Optimus deliveries by 2040. However, it contends that 2026 consensus estimates appear "far too high."

Meanwhile, Barclays analyst Dan Levy raised the firm's price target on Tesla to $350 from $275 while keeping an ‘Equal Weight’ rating on the shares.

Tesla enters third quarter (Q3) earnings with two contrasting "stories," namely an accelerating autonomous and AI narrative bolstered by Elon Musk's proposed compensation package and a weakening fundamental backdrop, the analyst told investors.

The firm is expecting a Q3 EPS beat, supported by gross margin and volume strength, but is "leaning neutral to slightly negative" into the print following a recent rally, given its "muted view" on fundamentals going forward, the analyst added.

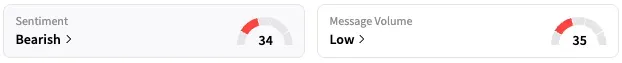

TSLA shares traded 2% lower at the time of writing. On Stocktwits, retail sentiment around TSLA stayed within the ‘bearish’ territory over the past 24 hours while message volume stayed at ‘low’ levels.

TSLA stock is up 6% this year and by about 93% over the past 12 months.

Read also: United Airlines Executive Highlights Healthy Leisure Travel, Improved Global Capacity Balance For Q4

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)