Advertisement|Remove ads.

Tesla Stock Edges Lower Premarket: Retail Traders Feel Bullish As Speculation Swirls About New Reveal

Tesla, Inc. (TSLA) stock fell about 0.20% in Tuesday’s early premarket session after climbing 5.5% to $453.25 in the previous session, amid signals that the broader market may pull back from its record high.

Monday’s rally was sparked by a few teasers released by the company over the past few days, with the market speculating that the company would launch a low-end Model Y variant or the new Roadster on Tuesday. Fund manager Gary Black is bracing for an affordable Model Y, reasoning that Tesla could be looking to leverage the brand’s appeal.

A separate teaser on Tesla’s official X handle showed a close-up video of what is widely believed to be an aerowheel. Shares of airtaxi maker Archer Aviation and e-VTOL company Joby Aviation have already seen a bump based on speculation of a potential partnership with Tesla.

Some social media users speculated that a graphics card from the Tesla stable could be in the cards. The user also said the stock would soar if their guess proved correct, and hit $1,000 by the year-end.

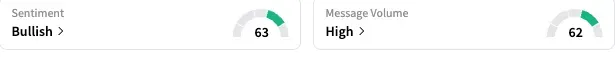

On Stocktwits, retail sentiment toward Tesla stock stayed ‘bullish’ by early Tuesday, and the message volume on the stream remained ‘high.’ A bullish watcher said the stock would “explode” at the reveal.

Tesla’s stock has gained over 12% year-to-date, after trading in the red for much of the year. After a period of consolidation between mid-May and early September, the stock began to take off, riding on the hopes of a strong third-quarter deliveries report and optimism over CEO Elon Musk shifting his focus back to his electric vehicle (EV) venture.

After the company reported record deliveries for the quarter, the stock pulled back over a couple of sessions, likely due to a “sell-the-news” move following the report, but rebounded strongly on Monday.

Notwithstanding the recent momentum, the stock is trading below its all-time high of $465.33, reached on Dec. 26, 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why AppLovin Stock Is Falling Over 2% Premarket Today

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)