Advertisement|Remove ads.

Tesla’s Week So Far: Q2 Earnings, Robotaxi Expansion, And Cheaper Model Promises Double Retail Chatter On Stocktwits

Retail chatter on Stocktwits around EV giant Tesla Inc. (TSLA) jumped 117% over the past seven days as investors geared up for the company’s second-quarter earnings and responded to the weak numbers.

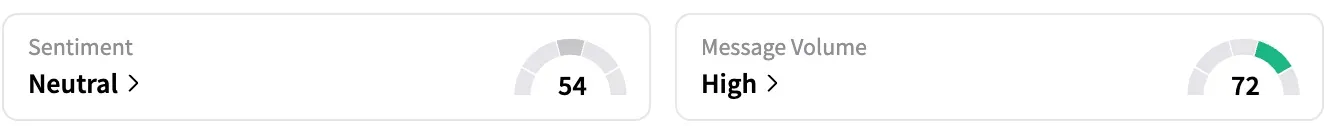

On Stocktwits, retail sentiment around Tesla improved from ‘bearish’ to ‘neutral’ territory over the past 24 hours, while message volume stayed at ‘high’ levels. Tesla stock, with over a million followers, was the top-trending stock on Stocktwits as of Friday afternoon, at the time of writing.

Tesla CEO Elon Musk on Wednesday warned of a “few rough quarters” ahead for the company on the heels of reporting a year-on-year decline in second-quarter (Q2) revenue and earnings.

The company’s automotive segment revenue declined by 16% in the quarter to $16.66 billion, while total revenue of $22.50 billion exceeded analyst estimates despite being lower than in Q2 2024. Tesla reported deliveries of 384,122 units in Q2, marking a 13.5% year-over-year decline and the second consecutive quarter of declining deliveries.

The company’s quarterly adjusted earnings per share came in at $0.40, down from $0.52 a year ago.

In a Stocktwits poll with approximately 2,300 respondents, 47% of investors said they are buying Tesla stock after earnings. Thirteen percent said they were holding, while 22% said they were selling or trimming their holdings.

Despite the regulatory headwinds, including the U.S. government’s decision to cut the $7,500 federal tax credit on new electric vehicle purchases later this year, Musk on Wednesday expressed optimism that autonomous driving capabilities would help restrengthen the company's financials.

"We probably could have a few rough quarters," Musk said. "I'm not saying we will, but we could – you know, Q4, Q1, maybe Q2, but once you get to autonomy at scale in the second half of next year, certainly by the end of next year, I think I'd be surprised if Tesla's economics are not very compelling."

Tesla executive Vaibhav Taneja also stated that the company incurred $300 million in tariffs during the second quarter, with two-thirds of the cost attributed to the automotive business and the remaining one-third to its energy generation and storage segment.

“However, given the latency in manufacturing and sales, the full impact will come through in the following quarters, and so costs will increase in the near term. While we are doing our best to manage these impacts, we are in an unpredictable environment on the tariff front,” he added.

The company also stated that it is working on a more affordable model, with volume production planned for the second half of 2025, at a slower pace than previously anticipated.

Tesla did not, however, provide a full-year vehicle delivery forecast, saying it is difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains, cost structure, and demand for durable goods and related services.

Musk also expressed optimism about launching the company’s robotaxi services, currently limited to Austin, in more cities, including California, Nevada, Arizona, and Florida.

According to a report by Business Insider on Friday, the EV maker informed employees that the timeline for the Robotaxi launch had been accelerated and could occur as soon as Friday. The memo to staff also stated that some Tesla owners would be invited to use the services, and users would pay for the Robotaxi rides.

Furthermore, on Thursday, President Trump stated that he does not intend to ‘destroy’ Elon Musk’s companies by revoking government subsidies, instead saying that he wants all U.S. businesses to ‘thrive like never before.’

Musk and Trump were at the center of a very public spat earlier this month, in which Musk said he would launch his political party and Trump hit back, saying that Musk was a “train wreck.”

TSLA stock is down approximately 21% this year but up about 44% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263007357_jpg_aff2a32e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_XRP_original_jpg_005097c9e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)