Advertisement|Remove ads.

Tesla Retail Investors Are Overwhelmingly Bearish About Q1 Earnings: Here's What Wall Street Expects

Tesla, Inc.'s stock will draw sharp interest this week as the electric vehicle giant gears to report quarterly financial results after the market closes on Tuesday.

The mood on Wall Street is extremely cautious following disappointing March-quarter deliveries. Analysts expect the company's first-quarter earnings per share to dip to $0.43 from $0.45 a year earlier and revenue to stay roughly flat at $21.45 billion.

Last week, the Fly reported that Barclays slashed its price target on Tesla to $275 from $325 while maintaining an 'Equal Weight' rating, saying the setup into Tesla's Q1 results is "confusing."

The research firm reportedly said Tesla faces questions about weakening fundamentals and expects Q1 auto margin, excluding credits, to hit a new low.

Barclays believes it will be tough for Tesla to achieve volume growth in 2025 but suggested there was potential for CEO Elon Musk to spark optimism by re-engaging with his company.

Musk has been spending more time in Washington, D.C., as part of President Donald Trump's Department of Government Efficiency (DOGE) since January, drawing the ire of investors and analysts alike.

However, Barclays added that Tesla's planned launch of unsupervised and driverless full self-driving in Austin in June could drive incremental excitement, and a "good narrative could outweigh weak fundamentals."

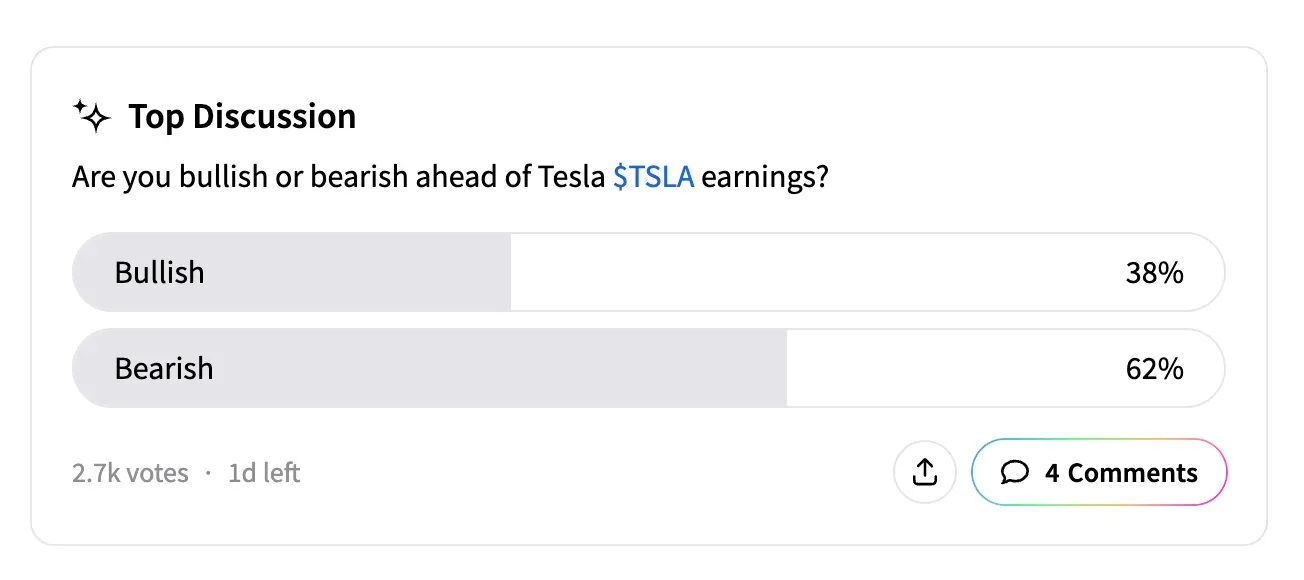

On Stocktwits, an ongoing poll asking users how they felt ahead of Tesla's Q1 results reveals that 62% of over 2,700 respondents voted "bearish" while only 38% were "bullish."

"On the earnings call, $TSLA investors are going to have a lot of questions the company probably doesn't have good answers for," said one skeptical user.

"Tesla should rebrand to 'Future promises.' That's all they sell," said another.

On Thursday, longtime Tesla bear and GLJ Research analyst Gordon Johnson urged investors to “aggressively short” Tesla stock through the second quarter, citing a record gap between his delivery forecast and Wall Street consensus.

Johnson estimates Q2 deliveries at 342,700 units — nearly 96,000 below current expectations. He added that the full impact of Musk's waning popularity would not be felt until the second quarter.

Investor sentiment could take another hit Monday after a Reuters report, citing sources familiar with the matter, said Tesla had delayed the production launch of its lower-cost Model Y.

Tesla stock is down more than 38% this year, the worst performer among the “Magnificent Seven” tech stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lowe_logo_resized_jpg_b9cb8f6035.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_grocery_shopping_inflation_original_jpg_3bbd9af886.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247547661_jpg_4e03c3ca3f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cleveland_cliffs_OG_jpg_53ba327db1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)