Advertisement|Remove ads.

Tesla’s Retail Base On Stocktwits Fears Trump's EV Policy Threat, Despite Elon Musk's Reassurance

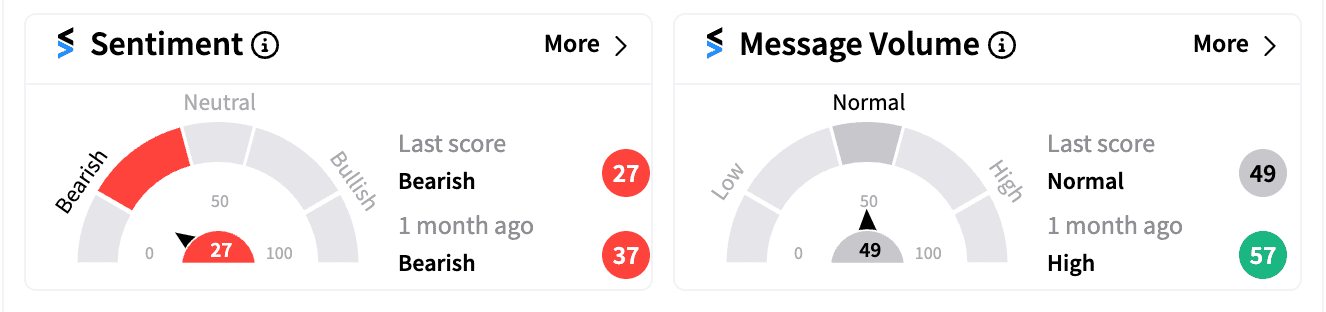

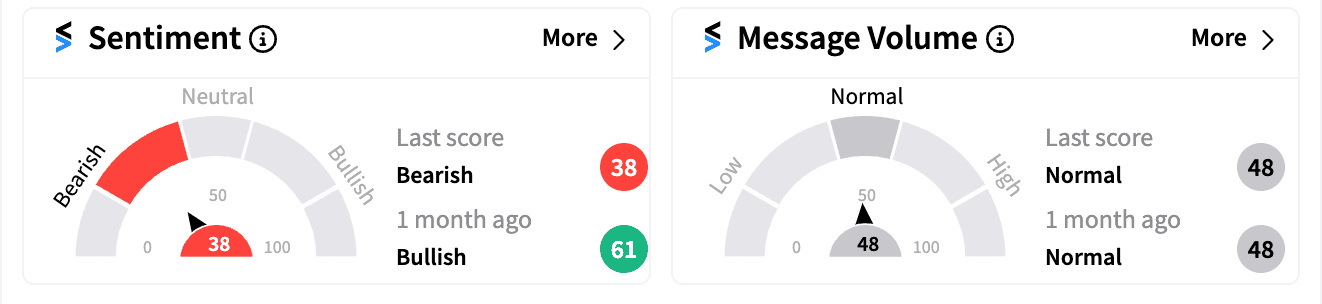

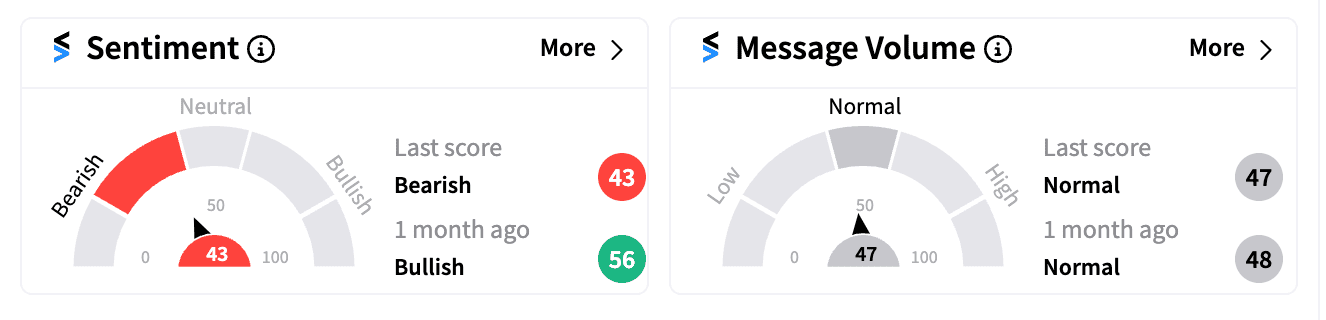

Tesla's stock price is taking a hit, dropping nearly 4% to $239.43 on Friday afternoon. On Stocktwits, retail sentiment towards Tesla (TSLA) has turned more bearish (27/100) compared to a month ago despite the stock’s recent surge.

Several factors are likely contributing to this negativity. First, former President Donald Trump's nomination speech on Friday has rattled the electric vehicle (EV) market. He vowed to “end the electric vehicle mandate on day one” if re-elected, referring to President Biden's EV policies, which he claims threatens the U.S. auto industry.

This threat, though potentially exaggerated (as Bloomberg noted that the Biden administration doesn't have a formal EV mandate) is causing concern. Other EV stocks like Rivian (RIVN) and Lucid (LCID), saw their shares — and retail sentiment — dipping alongside Tesla.

Tesla CEO Elon Musk, who recently endorsed Trump and pledged massive financial support, downplayed the potential impact of Trump's proposed policy, stating on X that Tesla doesn't rely on subsidies unlike its competitors.

While Musk's post garnered some support on Stocktwits, many retail investors remain skeptical. A key concern is the potential loss of regulatory credit sales, a lucrative side hustle for Tesla. These credits, earned by selling EVs in environmentally conscious markets, are then sold to automakers struggling to meet emission standards. According to Automotive News, Tesla has raked in a whopping $9 billion through this program since 2009.

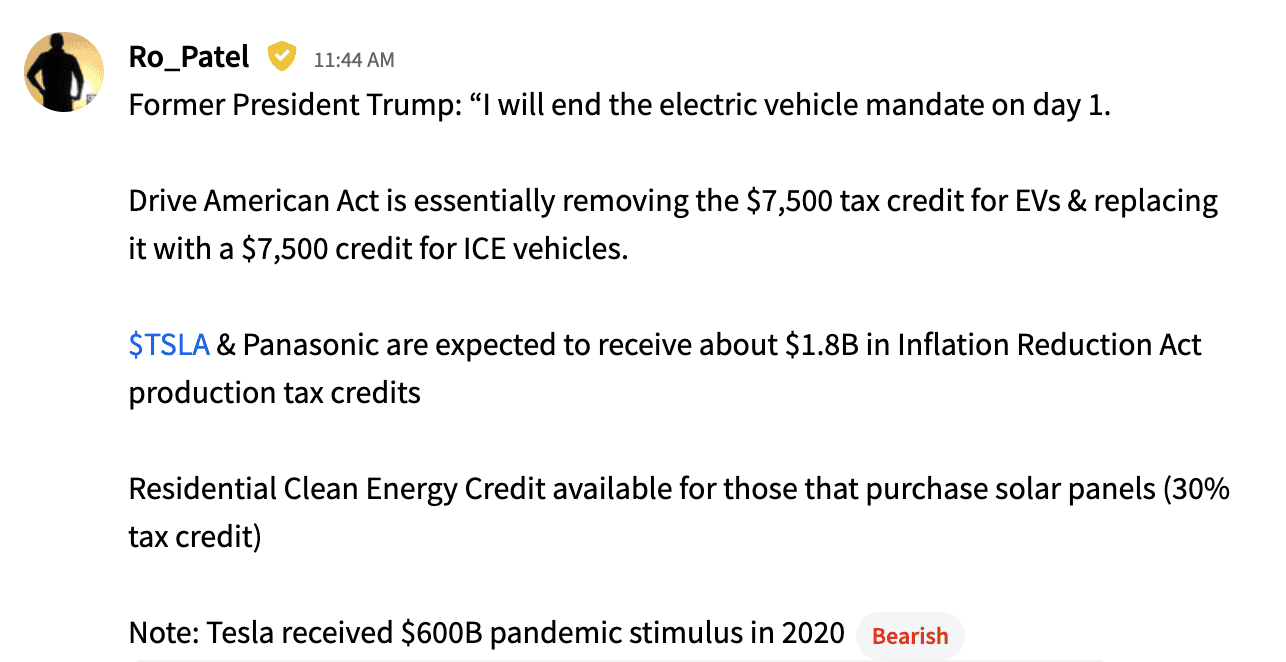

A popular post on the Tesla Stocktwits stream claimed that Trump’s proposed Drive American Act would essentially remove the $7,500 tax credit for EVs (under the Biden Administration’s program) and replace it with a $7,500 credit for gas-powered vehicles.

Beyond the political landscape, Tesla faces other headwinds. California, a crucial market, has seen a 24% drop in Tesla car registrations during Q2, marking the third consecutive quarter of declining sales there.

Additionally, Business Insider’s report about Tesla facing some production issues due to the recent IT outage linked to Microsoft and Crowdstrike, and Cathie Wood's Ark Invest offloading $8 million of Tesla shares are also contributing to the overall bearish sentiment.

One Stocktwits user wrote, "how is Elon supporting Trump? It's literally the opposite of what TSLA needs." A lot more in the retail community are probably wondering the same.

Tesla, the most watched symbol on Stocktwits with nearly 1 million followers, has lost over 3.60% year-to-date amid a slowdown in the EV sector and Musk’s pivot to a robotaxi-focused future.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)