Advertisement|Remove ads.

Tesla’s Big Q2 Test: Can Deliveries Offset The Fallout From A Musk-Trump Feud?

Tesla’s second-quarter delivery numbers are expected to be released on Wednesday, but what investors see on the page could be overshadowed by the political storm surrounding CEO Elon Musk.

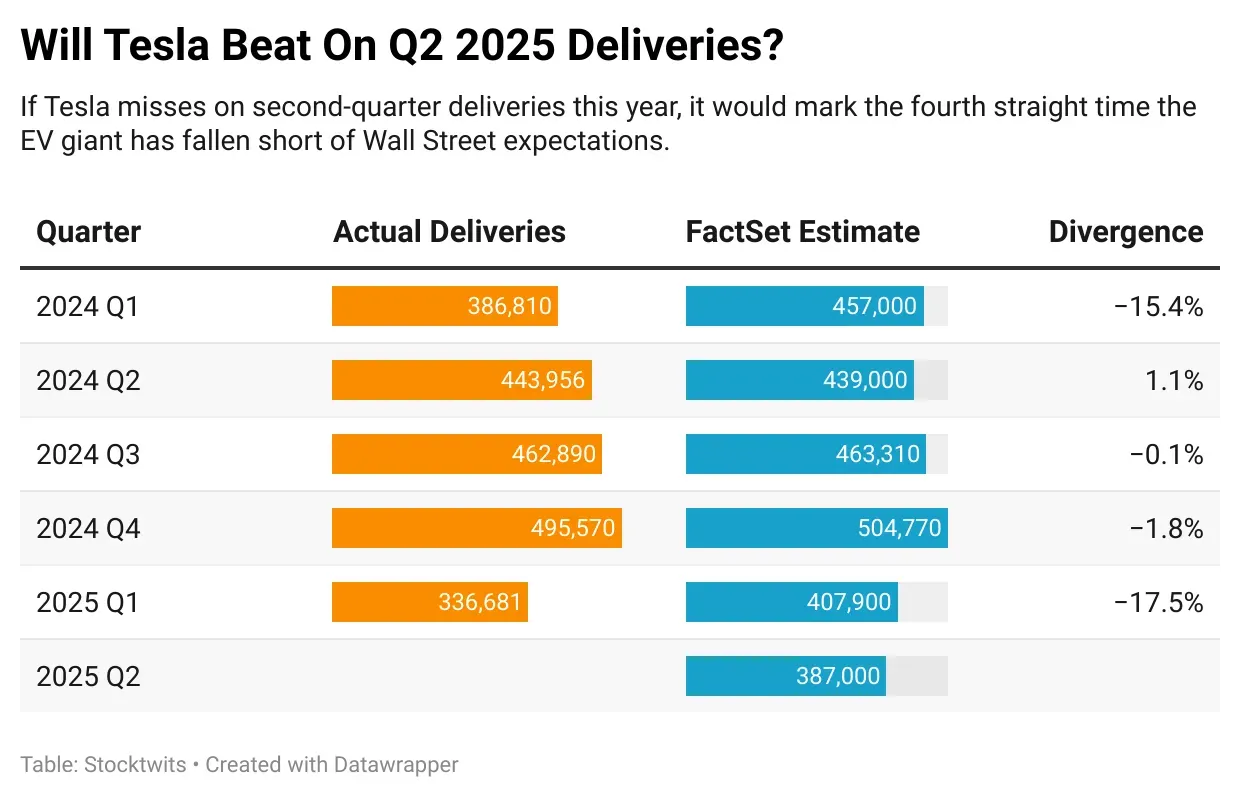

Wall Street expects another decline in quarterly deliveries, with the FactSet consensus at around 387,000, down 13% from a year ago, according to a CNBC report.

Traders on prediction market Kalshi told CNBC that they are betting even lower, around 364,000.

Tesla investor Gary Black said on X that he anticipates Q2 deliveries of 370,000, marking a 17% year-over-year decline. Still, he called the event a potential “buy the news” moment, given just how much sentiment has already cratered.

A miss would mark Tesla’s fourth consecutive delivery disappointment and the fifth time it has fallen short of Wall Street expectations since the first quarter of 2024.

Tesla shares have fallen about 7% since Friday’s close. They ended Tuesday 5.3% down at $300.71, marking their worst session in nearly a month.

That slide reflects not just delivery concerns but growing fallout from Musk’s intensifying clash with President Donald Trump — a feud that’s now spilling into Tesla’s bottom line.

It began when Musk criticized the president’s sweeping tax package — the so-called “One Big Beautiful Bill,” which slashes clean energy subsidies while expanding breaks for higher-income Americans.

Trump fired back on Truth Social on Tuesday, suggesting that without federal support, Musk would be forced to “close up shop and head back home to South Africa.”

The president also threatened to unleash the Department of Government Efficiency (DOGE) on Musk’s ventures like Tesla and SpaceX, adding that the billionaire could “lose a lot more” than just EV credits.

That threat wasn’t lost on Tesla investor Ross Gerber, who criticized the company’s board for staying silent amid escalating attacks.

“Not a peep from the Tesla BOD of this absurd attack on the President he enabled,” Gerber wrote on X.

His post came shortly after Trump suggested he’d move to scrutinize the subsidies and contracts that have helped Musk build his business empire.

Tesla has collected $11.8 billion in regulatory credit revenue since 2015 — a stream that accounted for 60% of its Q2 net income last year. SpaceX has received over $22 billion in federal contracts since 2008, according to CNBC, citing FedScout. Those figures explain why the feud has investors spooked.

Still, Musk has tried to recenter the conversation on Tesla’s innovation story. The company recently launched a limited robotaxi service in Austin, Texas, with what it called the first “driverless” vehicle delivery to a customer.

However, observers noted the presence of a safety driver and multiple disengagements during testing. Whether that effort will win over markets is unclear.

Tesla continues to face mounting pressure abroad.

In Europe, sales have fallen for five straight months. In China, Tesla’s market share slipped to 7.6% for the first five months of 2025, down from 10% last year and a high of 15% in 2020.

Analysts are watching to see whether price cuts or a long-rumored cheaper Model Y variant will arrive in time to reverse the trend, according to a Reuters report.

With competition intensifying from brands like Xiaomi and political headwinds gaining strength, Tesla’s delivery report may offer only a partial picture of the road ahead.

To meet Musk’s full-year growth target, Tesla would need to deliver more than a million vehicles in the second half of 2025 — a record-setting pace that many on Wall Street view as a long shot, according to the Reuters report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)