Advertisement|Remove ads.

Tesla’s Robotaxi Push Drives Stifel’s 25% Upside Call

- Analyst Stephen Gengaro highlighted significant progress in Tesla’s full self-driving (FSD) system.

- Stifel highlighted gains in Tesla’s robotaxi ambitions, noting expansion in Austin and the Bay Area.

- In the third quarter of 2025, Tesla reported delivering 497,099 vehicles.

Stifel has raised its price target for Tesla, Inc. (TSLA) to $508 from $483, while maintaining a ‘Buy’ recommendation, citing strong third-quarter (Q3) results and promising advances in autonomous driving as justification for the boost.

The new price target signals a 25% upside to the company’s closing price as of Friday.

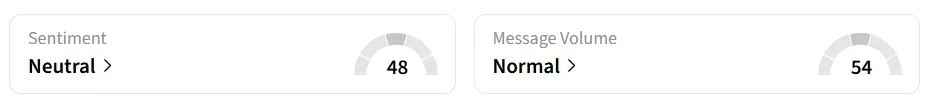

Tesla’s stock traded over 1% lower in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘normal’ message volume levels.

Why Stifel Is Bullish

According to a CNBC report, analyst Stephen Gengaro points to what he calls meaningful progress in Tesla’s full self-driving (FSD) system, noting that upcoming updates will introduce reasoning capabilities like improved decision-making for parking.

He also highlighted gains in Tesla’s robotaxi ambitions, noting expansion in Austin and the Bay Area as well as planned entry into eight to ten U.S. metro areas by the end of 2025.

“We also believe TSLA’s AI-based Full Self-Driving (FSD) initiative has the potential to generate significant value through both sales of FSD, possible licensing agreements, and as critical part of longer-term Cybercab (Robotaxi) initiatives,” said Genargo.

Sales Momentum

Tesla’s recent financials also justify the optimism, according to the analyst. Despite near-term risks, such as expiration of the U.S. electric-vehicle tax credit, Gengaro remains confident in Tesla’s multi-year trajectory.

In the third quarter of 2025, Tesla reported delivering 497,099 vehicles, marking a 7.4% year-over-year growth and its highest quarterly deliveries to date.

The company pulled in $28.10 billion in revenue in Q3, easily outpacing Koyfin’s forecast of $26.7 billion. Q3 revenue rose 12% year-on-year.

TSLA stock has gained over 19% in the last 12 months.

Also See: Why Did Dell Technologies Tumble 5% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)