Advertisement|Remove ads.

Tesla Stock Dips Over 3% Premarket: Mizuho Hikes Price Target On AI, Robotics Hopes

- Tesla shares slipped in premarket trading even as Mizuho raised its price target to $485, saying the company’s long-term story is shifting from electric vehicles to AI, robotics, and self-driving technology.

- The decline followed Q3 results, with adjusted EPS missing Koyfin estimates despite record revenue as rising costs, tariffs, and narrowing margins weighed on sentiment.

- Retail traders on Stocktwits turned bearish, warning that Tesla’s growth was front-loaded by tax credits and predicting further weakness below the $410 level despite bullish analyst targets.

Tesla Inc. shares fell over 3% in premarket trading on Thursday even after Mizuho raised its price target on the stock to $485, maintaining an ‘Outperform’ rating and arguing that the company’s long-term growth lies in AI, robotics, and self-driving, not its core EV business.

The stock fell nearly 4% in early Frankfurt trading on Thursday and is expected to extend losses when U.S. markets open later in the day.

Mizuho Sees AI, Robotics As Key To Tesla’s Future

Mizuho raised its Tesla price target to $485 from $450, reiterating an Outperform rating. The brokerage said Tesla’s robotaxi expansion, Optimus humanoid robot, and full self-driving (FSD) technology were central to its long-term investment case.

“We believe TSLA continues to be less an EV story and more a focus on robotaxis, humanoid robots, and autonomous FSD driving upside and multiples,” Mizuho analysts wrote in a note, according to a report by Investing.

The firm estimated that only about 12% of Tesla owners currently subscribe to its FSD software, but said improvements to the system could boost adoption. Mizuho added that further ramp-ups of the Optimus robot and the upcoming Cybercab robotaxi in the next few quarters could help offset the slowdown in Tesla’s electric vehicle sales.

However, the brokerage also warned of near-term pressure from weakening EV demand, forecasting Tesla’s 2025 deliveries at 1.67 million vehicles, a 7% year-on-year decline.

Earnings Review

Tesla’s adjusted EPS fell 31% to $0.50, below Koyfin’s estimate of $0.56, while revenue rose 12% to $28.1 billion, above Koyfin’s forecast of $26.7 billion. Operating expenses surged 50% to $3.4 billion due to higher AI and R&D spending, while U.S. tariffs on auto parts added $400 million in costs. Operating income dropped 40% to $1.6 billion, with margins narrowing to 5.8% from 10.8% a year earlier.

CEO Elon Musk reiterated during the call that AI, robotics, and the upcoming Cybercab robotaxi remain key focus areas, as Tesla works to expand its real-world AI capabilities through its in-house AI5 chip.

Stocktwits Users Warn Of Mounting Cost Pressure

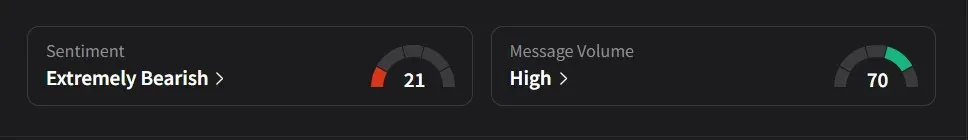

On Stocktwits, retail sentiment was ‘extremely bearish’ amid ‘high’ message volume.

One user warned that Tesla’s recent quarter benefited from its final round of U.S. tax credits and front-loaded demand, adding that costs were rising faster than revenue and that the company had little room to raise prices. They argued that this dynamic left Tesla “doomed” if trends persisted.

Another user predicted that the stock would continue to weaken, saying the $410 level would “be broken easily,” as it had been several times over the past few years.

Tesla’s stock has risen 9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1251437157_jpg_2ebb5f0c8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249830196_jpg_a4d60d5f3b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225995334_jpg_67de820c56.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)