Advertisement|Remove ads.

Tesla’s Retail Army Keeps The Faith In Musk After Yet Another Poor Quarterly Showing

Tesla, Inc., the electric vehicle giant led by the enigmatic Elon Musk, is facing a storm of investor sentiment. The company's shares plummeted over 6.50% in premarket trading on Wednesday, following a lackluster Q2 earnings report. Despite the downturn, a curious resilience persists among retail investors, largely fueled by Musk's unwavering optimism.

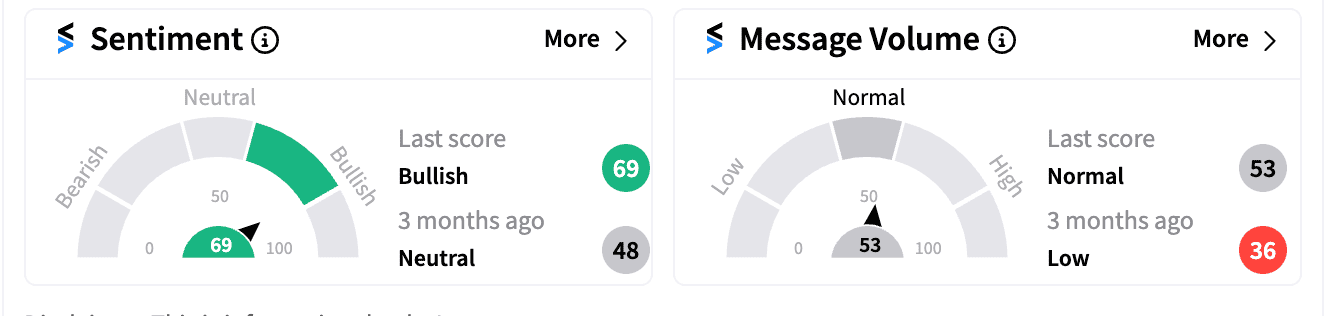

Stocktwits data showed that most retail investors are still bullish (69/100) on the EV stock.

The cracks in Tesla's armor are evident. The company reported its lowest profit margin in over five years, according to Reuters, falling short of Wall Street expectations. This was primarily due to aggressive price cuts to stimulate demand and increased spending on ambitious AI projects.

Yet, Musk remains steadfast in his vision, asserting that the company's true value lies in its autonomous driving technology. “The value of Tesla overwhelmingly is autonomy. These other things are in the noise relative to autonomy,” he said Tuesday, and again went as far as challenging skeptics to sell their shares.

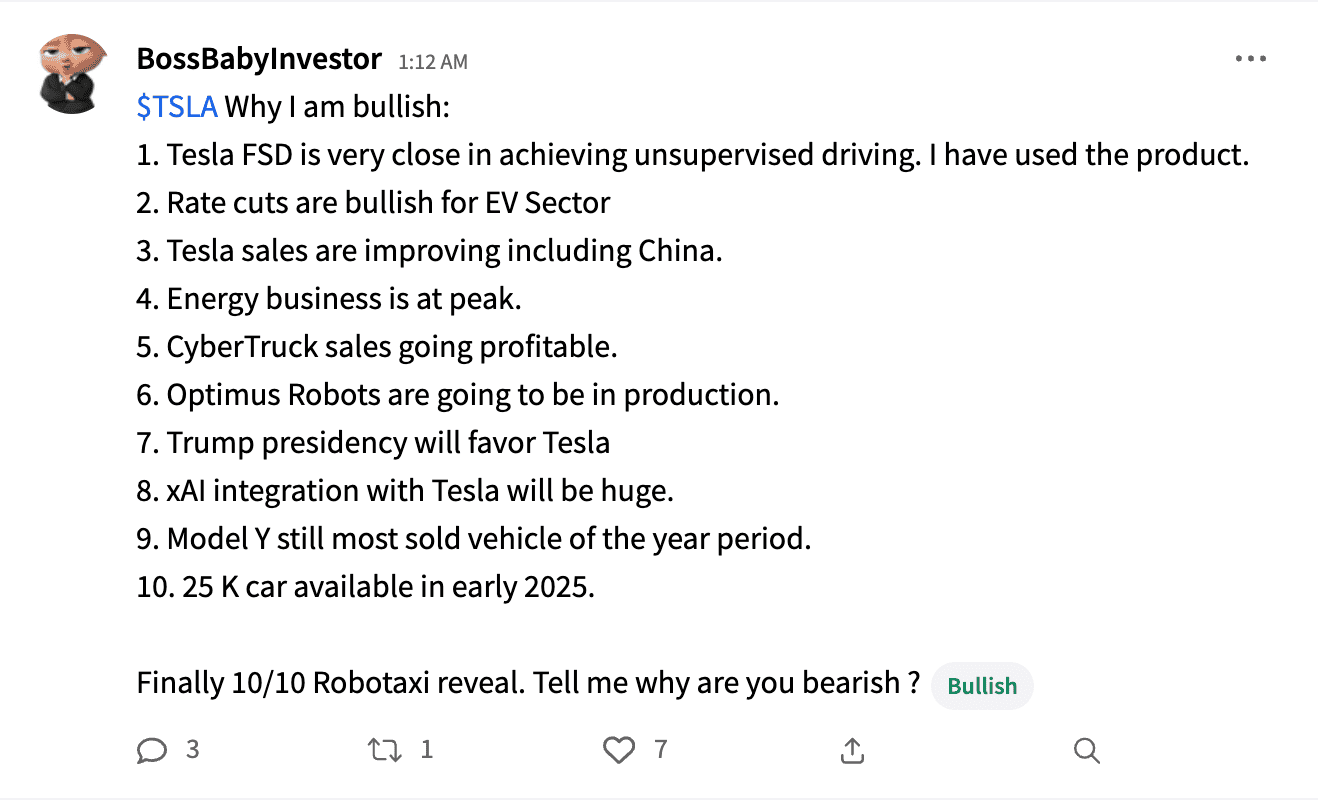

A chorus of bullish retail investors, exemplified by the user "Boss Baby Investor" on Stocktwits, echoed Musk's confidence. The user pointed to the imminent breakthrough in Tesla's Full Self-Driving (FSD) technology, the potential tailwinds from anticipated interest rate cuts, and the burgeoning energy business as reasons for optimism.

The promise of more affordable Tesla models in 2025, though reportedly delayed in terms of cost reductions, also fueled some bullish enthusiasm.

However, the delayed unveiling of robotaxis prototypes in October and the decision to postpone the Mexico plant until after the U.S. election introduced new variables.

Musk also downplayed the potential impact of a Trump presidency amid a complex political landscape. While he acknowledged that a Trump victory could jeopardize the subsidies provided by the Inflation Reduction Act, Musk suggested it could potentially benefit Tesla by crippling competitors.

Conversely, bears pointed to the chances of a Kamala Harris presidency — who has reportedly opened up a marginal lead over Trump after President Joe Biden exited the 2024 race and endorsed her — throwing a wrench in the works.

The stark contrast between the bullish retail sentiment and the broader market's skepticism is striking. Deepwater Asset Management's Gene Munster, a known Tesla bull, urged investors to maintain focus on FSD, autonomy, and robotics. “TSLA investors are used to waiting. The reason why the stock is drifting lower in after-hours is because the dip in margins in June elevated investors’ desire to hear more details on 2025 product announcements. In three months, investors will get the details they're looking for,” he wrote on X.

Ultimately, Tesla finds itself at a familiar crossroads. Tuesday’s results have sent the company’s shares back in the red year-to-date, indicating that the broader market is keen on seeing tangible results sooner than later.

Photo courtesy: UK Government on Wikimedia Commons

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)