Advertisement|Remove ads.

Retail Bets TG Therapeutics Stock Can Sustain Post-Earnings Gains Throughout The Week

Shares of TG Therapeutics, Inc. (TGTX) surged 14.4% on Monday, marking their best single-day performance in nearly seven months.

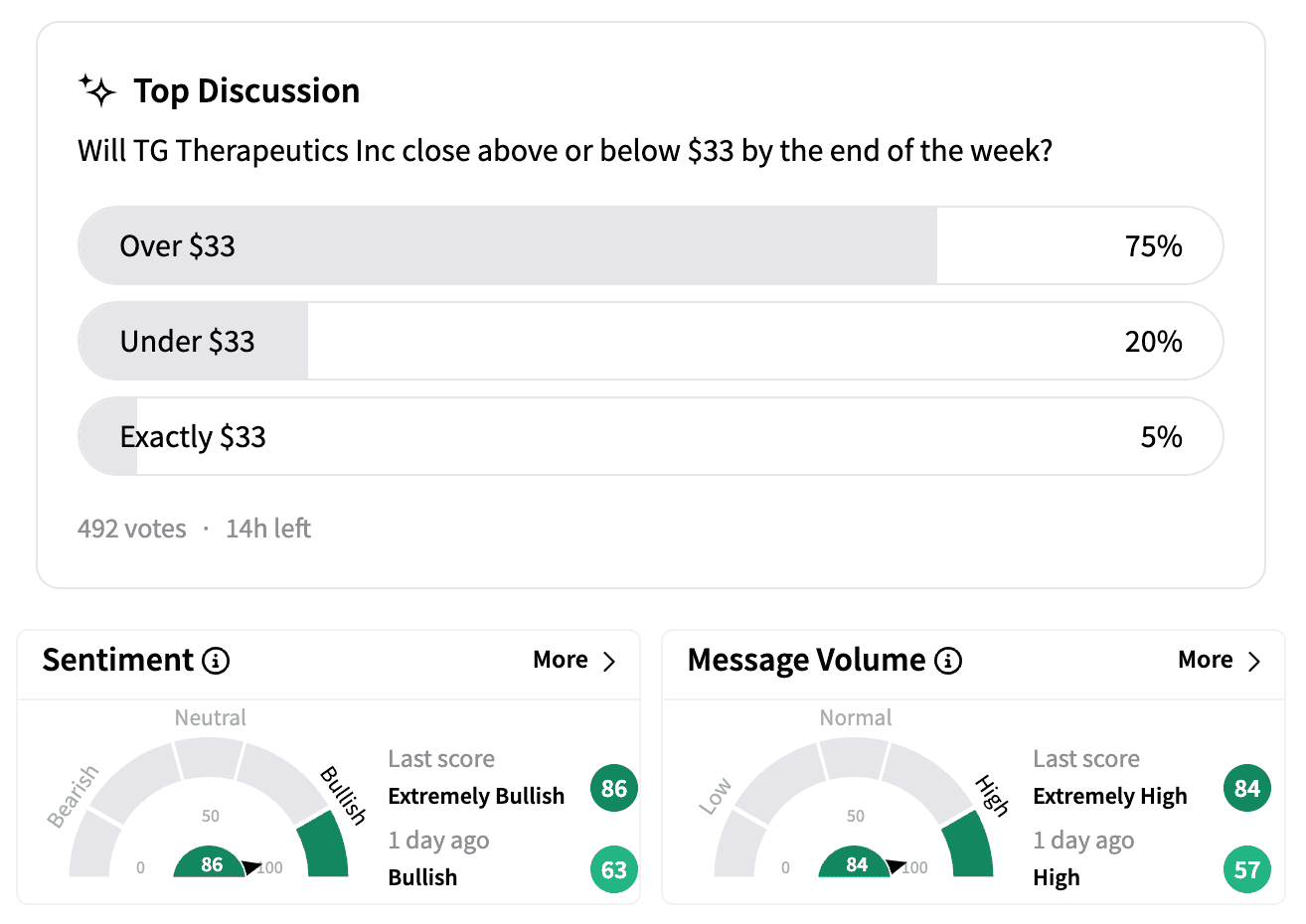

The rally followed the company's quarterly earnings release, with retail sentiment on Stocktwits turning 'extremely bullish' as message volume spiked more than 5,000% in the 24 hours leading up to the close.

The company reported fourth-quarter net income of $0.15 per diluted share, swinging from a loss of $0.10 a year earlier, though slightly missing analysts' expectations of $0.16 per share.

Revenue for the quarter more than doubled to $108.2 million from $44 million, easily surpassing estimates of $100.7 million.

Briumvi, TG Therapeutics' B-cell therapy for multiple sclerosis was a key growth driver. Annual revenue from the drug more than tripled, with U.S. net product revenue reaching $103.6 million in the fourth quarter and $310 million for the full year.

The company has guided for 2025 revenue of around $540 million, slightly above analyst projections, with Briumvi's U.S. revenue expected to account for approximately $525 million.

TG Therapeutics also highlighted Phase 3 trial data showing that 92% of patients with relapsing multiple sclerosis remained free from disability progression after five years of treatment with Briumvi.

As of Dec. 31, 2024, the company reported $311 million in cash, cash equivalents, and investment securities, stating that its financial position — combined with Briumvi's projected revenue — would be sufficient to fund operations under its current plan.

Retail traders have latched onto the stock's momentum. A Stocktwits poll showed that more than 75% of the respondents believe TGTX could close above $33 by week's end. About 20% expect the stock to drop below $33.

The latest earnings beat has also reignited speculation about a potential buyout.

One user on Stocktwits pointed to Sanofi as a possible suitor and suggested Novartis could be closely monitoring developments related to a subcutaneous version of Briumvi.

Another speculated that TG Therapeutics, whose projected sales now exceed half a billion dollars, could be valued at $12 billion to $15 billion in an acquisition.

Market chatter last year hinted at bid interest from AstraZeneca, GSK, and Novartis, with Roche seen as a possible frontrunner at an estimated price of $60 per share.

TGTX shares are up more than 12% year-to-date. According to Koyfin data, five of the eight analysts covering the stock on Wall Street rate it a 'Buy,' two a 'Strong Buy,' and one a 'Strong Sell.'

The stock was falling marginally in Monday's after-hours trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225995334_jpg_67de820c56.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_OG_jpg_67b04c304a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)