Advertisement|Remove ads.

This Cybersecurity Stock Hit Record Highs And Drew Wall Street Praise After Blowout Q1: More Details Inside

Commvault Systems Inc. (CVLT) stock reached an all-time high after attracting bullish attention from Wall Street following a standout first quarter (Q1) and an upgraded forecast for the year.

The data protection and cybersecurity company received price target boosts from several brokerages, citing strong performance and momentum in the backup and recovery segment.

Commvault Systems stock pared some of the gain and traded at $193.52 at the time of writing.

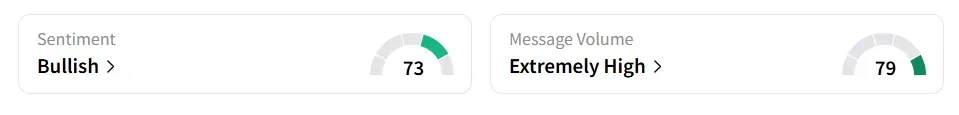

On Stocktwits, retail sentiment toward the stock remained in ‘bullish’ (73/100) territory. Message volume improved to ‘extremely high’ (79/100) from ‘high’ levels in 24 hours.

KeyBanc Capital Markets raised its price target on Commvault to $225 from $195, while maintaining its ‘Overweight’ rating, as per TheFly.

The brokerage expressed confidence in the company's accelerating performance trajectory, highlighting better-than-expected annual recurring revenue (ARR) in constant currency terms and a positive full-year outlook.

DA Davidson also lifted its price target to $220 from $200 and reiterated a ‘Buy’ rating.

The firm noted that a few significant contracts signed just before quarter-end contributed to the strong numbers.

DA Davidson expects Commvault's Cyber Resilience offerings, which command higher average selling prices, to make up a growing portion of the company’s future ARR.

Cantor Fitzgerald raised its target to $189 from $173, but maintained a ‘Neutral’ stance on the stock.

The brokerage acknowledged Commvault’s Q1 beat and revised fiscal 2026 guidance, attributing these results to broader industry tailwinds and the company’s operational discipline.

The firm said the improved fundamentals are already being reflected in the stock’s valuation.

Commvault’s Q1 ARR climbed 24% year-on-year (YoY) to $996 million, and the subscription grew 46% YoY to $182 million.

The company’s revenue of $282 million and adjusted earnings per share (EPS) of $1.01 surpassed the analysts’ consensus estimate of $267 million and $0.97, respectively, as per Fiscal AI data.

Commvault stock has gained over 28% in 2025 and in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)