Advertisement|Remove ads.

Marvell Stock Is Trending On Wednesday Morning: Here’s Why South Korea’s Rebellions And Microsoft Are In The Picture

Marvell Technology Inc. (MRVL) garnered retail traders’ interest on Wednesday after Rebellions Inc., a South Korean artificial intelligence chipmaker, announced a strategic alliance with the company to develop AI infrastructure.

Also, traders highlighted the fact that Microsoft Corp.’s (MSFT) fourth-quarter earnings, due on Wednesday evening, are likely to give a lift to Marvell.

Marvell Technology stock traded over 9% higher on Wednesday, after the morning bell.

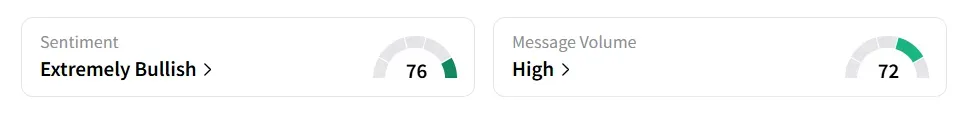

On Stocktwits, retail sentiment toward the stock improved to ‘extremely bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘high’ from ‘normal’ levels in 24 hours.

Both retail sentiment and message volume hit a month-high. The stock saw a 44% increase in user message count in the last 24 hours.

A Stocktwits user highlighted the fact that Rebellions is Asia's leading independent AI semiconductor platform.

Another user sounded excited, saying Microsoft’s earnings, if positive, might support Marvell stock.

Microsoft uses Marvell's LiquidSecurity hardware security modules (HSMs) in Azure to handle encryption, manage cryptographic keys, and perform various security-related tasks.

Rebellions and Marvell’s collaboration centers on designing advanced AI accelerators optimized for large-scale inference tasks.

The companies aim to serve the growing demand for customized, energy-efficient systems capable of supporting sovereign-backed digital initiatives and locally governed cloud computing efforts.

This development comes as geopolitical tensions and growing AI needs push governments to prioritize homegrown or regionally aligned technology strategies.

Meanwhile, Morgan Stanley has revised its outlook on Marvell, raising the firm's price target to $80 from $73 while maintaining an ‘Equal Weight’ rating on the stock, as per TheFly.

The firm cited a growing belief in the long-term potential of AI as the driving force behind the updated valuation.

Marvell stock has shed 24% year-to-date and has gained over 33% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)