Advertisement|Remove ads.

This Media Giant Is Attracting A Lot Of Retail Attention Today: Here’s Why

Comcast Corp.’s (CMCSA) CFO, Jason Armstrong, highlighted during the company’s earnings call on Thursday that the second-quarter (Q2) earnings were boosted by broadband, wireless, and theme parks businesses.

Referring to the company’s connectivity and content divisions, he said that collectively, these businesses represent nearly 60% of the company’s total revenue and grew at a high single-digit rate this quarter.

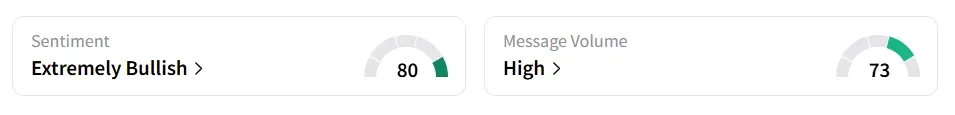

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ (80/100) from ‘bullish’ the previous day amid ‘high’ (73/100) message volume levels.

Both the sentiment and message volume were at a three-month high. The stock saw an 80% increase in user message count in 24 hours.

Comcast stock traded over 2% higher on Thursday mid-morning.

A Stocktwits user lauded the different revenue streams in the company.

Comcast’s President, Michael Cavanagh, said that half of the new eligible sign-ups in Q2 have chosen the 5-year price guarantee. Additionally, 20% more new customers opted for gigabit or faster internet speeds, boosting the average speed offerings and contributing to higher revenue per new connection.

The company’s Q2 revenue increased 2.1% year-on-year (YoY) to $30.3 billion, beating the analysts’ consensus estimate of $29.8 billion, as per Fiscal AI data.

The adjusted earnings per share (EPS) of $1.25 also surpassed the consensus estimate of $1.18.

Comcast’s operating cash flow in Q2 totaled $7.8 billion, with a free cash flow of $4.5 billion.

The company returned a total of $2.9 billion to shareholders in Q2, distributing $1.2 billion in dividends and buying back 49.3 million shares for $1.7 billion.

Comcast stock has lost over 11% year-to-date and over 19% in the past 12 months.

Also See: Retail Traders Flock To CoreWeave After Citi Upgrade Sparks AI Optimism

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)