Advertisement|Remove ads.

Tim Cook Eyes Larger AI Acquisitions As Apple Breaks From Tradition: ‘We're Very Open To M&A That Accelerates Our Road Map’

Apple Inc. (AAPL) is preparing to spend more on artificial intelligence, marking a change from its usual careful approach to buying companies and building infrastructure.

On Thursday, CEO Tim Cook confirmed the tech giant is open to purchasing larger companies to speed up its AI development.

“We're very open to M&A that accelerates our road map. We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature,” said Cook in the third-quarter (Q3) earnings call.

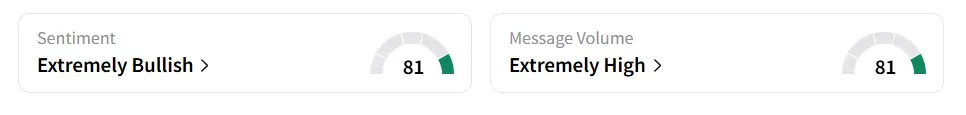

Apple stock traded over 2% lower on Friday afternoon. On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ (81/100) from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ (81/100) from ‘high’ levels in 24 hours.

The stock experienced a 175% increase in user message count in 24 hours, as of Friday morning. A bullish Stocktwits user said ‘Cook knows what he needs to do.’

According to a Reuters report, while Apple has typically built AI tools in-house and leaned on outside cloud providers, it now appears poised to spend more aggressively to close the gap with competitors like Microsoft Corp. (MSFT) and Alphabet Inc. (GOOGL).

These rivals have poured tens of billions into data centers and have captured broad public attention with their generative AI tools.

Apple’s largest historical acquisition remains its $3 billion purchase of Beats Electronics in 2014. But industry shifts, including growing pressure on its default search partnership with Google and emerging AI search tools, may push Apple toward more transformative deals.

The iPhone makers’ Q3 revenue of $94 billion and earnings per share (EPS) of $1.57 surpassed the analysts’ consensus estimate of $89.16 billion and $1.43, respectively, as per Fiscal AI data.

Apple stock has shed over 19% year-to-date and 7% in the last 12 months.

Also See: Cloudflare Adds Record High-Spending Clients, Retail’s Buying The Dip

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)