Advertisement|Remove ads.

Cloudflare Adds Record High-Spending Clients, Retail’s Buying The Dip

Cloudflare Inc. (NET) CEO Matthew Prince said the company saw a 22% year-on-year (YoY) increase in large customers, now totaling 3,712, who contributed 71% of the second-quarter’s (Q2) revenue.

“We now have 3,712 customers paying us more than $100,000 per year, a 22% increase year-over-year,” Prince said in the Q2 earnings call on Thursday.

Cloudflare CFO Thomas Seifert said that the company added a record number of clients spending more than $1 million and even over $5 million in Q2, boosting its expansion efforts.

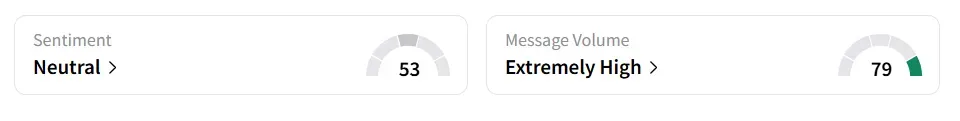

The stock saw a 721% increase in user message count in 24 hours. On Stocktwits, retail sentiment toward the stock remained in ‘neutral’ territory, with the message volume shifting to ‘extremely high’ from ‘high’ levels in 24 hours.

Cloudflare stock inched 0.6% lower on Friday morning. Stocktwits users said they are buying the dip.

The company’s Q2 revenue climbed 28% YoY to $512.3 million, beating the analysts’ consensus estimate of $501.59 million as per Fiscal AI data. Adjusted earnings per share (EPS) of $0.21 also exceeded the consensus estimate of $0.18.

Cloudflare expects Q3 revenue between $543.5 million and $544.5 million with an adjusted EPS of $0.23.

For the fiscal year 2025, the company sees revenue between $2.113 billion and $2.115 billion and an adjusted EPS in the range of $0.85 and $0.86.

Bank of America increased its price target for Cloudflare to $240 from $235 and maintained a ‘Buy’ rating on the stock, as per TheFly.

The firm noted that the Q2 revenue growth exceeded Wall Street estimates, and the company's guidance for Q3 also topped expectations.

The firm said it remains confident in Cloudflare's performance, with a belief that it is "firing on all cylinders, with strong demand signals.”

Cloudflare stock has gained 90% year-to-date and over 175% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)